In the world of financial planning, one term that often comes up is “asset allocation.” Asset allocation is the practice of dividing an investment portfolio across different asset classes to balance risk. Think a pie chart. It’s a foundational concept that plays a crucial role in designing investment portfolios. But while it may sound straightforward, the reality is far more nuanced. In fact, I’d argue that asset allocation is more of an art than a science.

Listen anywhere you stream Podcasts

iTunes | Spotify | iHeartRadio | Amazon Music

What is Asset Allocation?

At its core, asset allocation refers to how an investment portfolio is divided among different asset classes. These can include equities (stocks), fixed income (bonds), private equity, commodities, real estate, and even modern additions like cryptocurrencies such as Bitcoin. The goal is to find the right mix that balances risk and reward based on the investor’s goals, time horizon, and risk tolerance.

Often, the first step in determining asset allocation is through some sort of quiz or a conversation with a financial advisor. These quizzes typically ask questions designed to assess risk tolerance—how much market volatility an investor can stomach. They aim to gauge whether someone would prefer a conservative approach, leaning more towards fixed income and less risky investments, or a more aggressive strategy, favoring equities and other higher-risk assets.

Why Asset Allocation is an Art, Not a Science

Why do I call asset allocation an art rather than a science? The answer lies in the human element. For the many years I’ve been in this industry, I have yet to see a quiz that can’t be manipulated or one where people don’t try to put their best foot forward.

Investors often say they want all the upside and none of the downside. And why wouldn’t they? If we could guarantee such outcomes, everyone would be wealthy, and financial planning would be a breeze. But reality doesn’t work like that. There’s no perfect formula that offers maximum returns with zero risks. Even the best investors can’t avoid downturns entirely.

Most quizzes ask questions like, “Would you be willing to take a 50% loss for the chance of a 150% gain?” People tend to focus on the potential gains and say “yes” without fully understanding the emotional impact of actual losses. Here’s another issue: quizzes often frame things in percentages, but real-life losses are felt in dollars. For example, a 10% loss on a $2 million portfolio isn’t just 10%; it’s $200,000. When markets are down, people think about what those lost dollars could have bought—a new car, a home, years of living expenses. These losses are visceral and deeply personal.

Conversely, when the market is up, we often think in percentages rather than dollar gains. We may say, “My portfolio is up 20%,” without immediately converting that to actual dollar gains. This inconsistency in how we perceive gains versus losses underscores the complexity of human emotions in investing, making asset allocation an art that requires understanding psychology, not just spreadsheets.

The Role of Emotions in Investing

The emotional response to gains and losses can lead investors to make irrational decisions. Fear and greed are two powerful emotions that drive market behavior. During a market downturn, investors may panic, thinking, “This time is different; it’s going to zero. I need to get out now.” This reaction is called capitulation, and it’s the point at which investors sell off their investments to avoid further losses. But by selling when the market is low, they lock in their losses and miss the eventual recovery.

For instance, during the 2008 financial crisis, the markets fell over 50%. If you were heavily invested in equities and panicked, selling your investments to move into a more conservative portfolio, you would have locked in those losses. When the markets rebounded, as they historically have, those conservative investments wouldn’t have recovered as quickly as a diversified portfolio that stayed the course. This is why it’s essential to maintain a consistent risk tolerance. Selling low and buying high is a recipe for long-term underperformance.

Learning from the Great Investors

Even the most successful investors have faced significant downturns. Ray Dalio, known for his “All Weather” portfolio designed to perform well in any economic environment, still saw his strategy down by 20% in 2022. Warren Buffett, perhaps the most renowned investor of our time, saw his portfolio down by approximately 24% in 2022 and nearly 50% during the 2008 crisis. Yet, over the long term, these investors have achieved phenomenal returns. The key is their ability to stay invested through the tough times, not letting fear dictate their investment decisions.

Finding Your Comfort Zone

Working with a CERTIFIED FINANCIAL PLANNER™ can help tailor an asset allocation strategy that aligns with your comfort zone, goals, and life situation. A good advisor takes the time to understand your emotional triggers. They’ll know how to guide you through downturns without making knee-jerk reactions that could harm your financial future.

Risk tolerance isn’t static—it changes with life events, age, and personal circumstances. When you’re working and have a steady income, you might feel more comfortable taking on risk than when you’re retired and living off your investments. The birth of a child, the death of a parent, or even market news can shift your risk tolerance.

Timing the Market vs. Time in the Market

One of the common misconceptions among investors is the idea of timing the market—getting out when things are bad and getting back in when things look good. While it sounds logical, it’s nearly impossible to do consistently. The market often moves without clear signals, and by the time you react, it’s usually too late. Instead, a more reliable strategy is to focus on “time in the market.” Staying invested over the long term allows you to ride out the volatility and benefit from compounding returns.

The Value of Diversification

Another crucial aspect of asset allocation is diversification—not putting all your eggs in one basket. By spreading investments across various asset classes, sectors, and geographies, you reduce the impact of a downturn in any single area on your overall portfolio. Diversification doesn’t eliminate risk, but it can mitigate it, providing a smoother ride during turbulent times.

The Science of Asset Allocation: Data and Analysis

While I’ve emphasized the art side, there’s no denying that science plays a role in asset allocation. Data analysis, historical performance, economic forecasts, and quantitative models all contribute to determining the optimal asset mix. However, these tools should be seen as guides rather than definitive answers. They provide valuable insights, but they can’t predict the future or account for every nuance of human behavior.

Making Asset Allocation Work for You

Creating a well-balanced portfolio that aligns with your risk tolerance and investment goals is the ultimate aim of asset allocation. It’s about managing the trade-off between risk and return, ensuring you’re neither too aggressive nor too conservative. A portfolio should reflect not just your financial goals but your emotional comfort zone. The peace of mind that comes from knowing you’re invested in a way that feels right for you is invaluable.

Final Thoughts

Navigating the complexities of asset allocation can be daunting. Partnering with a knowledgeable advisor can provide clarity and guidance, helping you avoid emotional pitfalls and stay focused on your long-term goals. An advisor serves as a steady hand, keeping you grounded during market turbulence and ensuring your portfolio evolves with your changing needs.

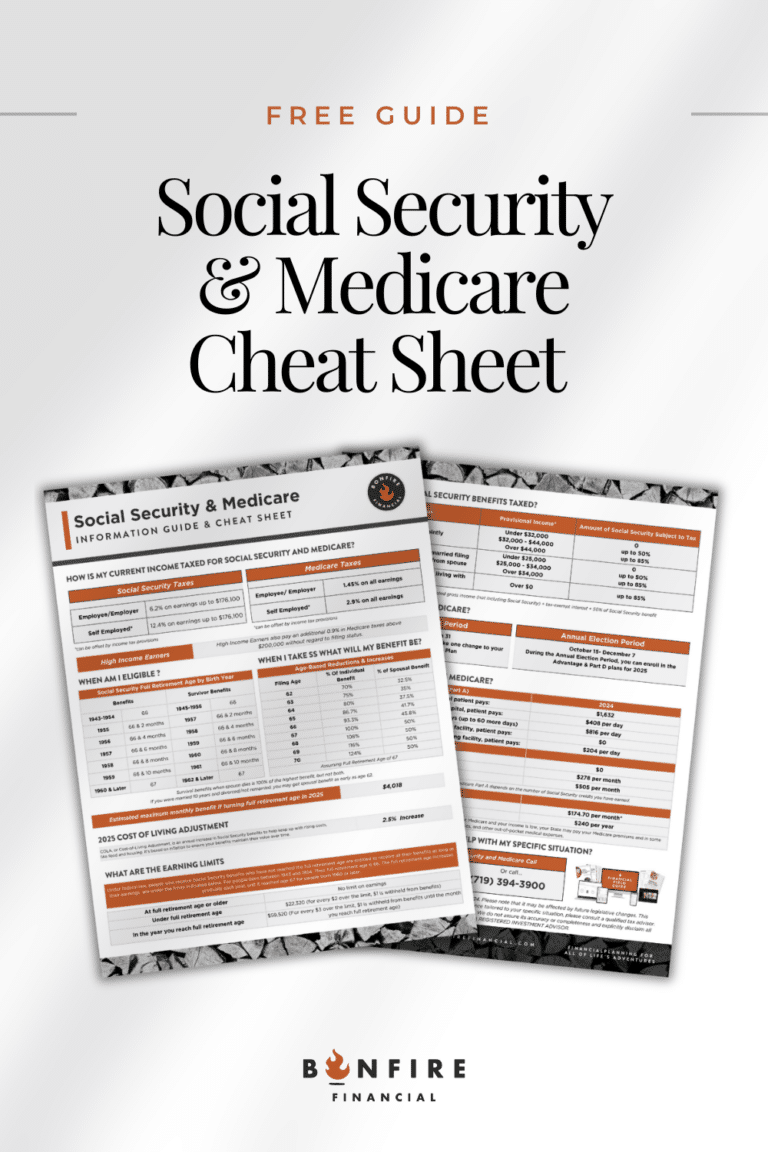

At Bonfire Financial, we specialize in helping clients find that balance and strategically slice up your investments. We listen to your goals, understand your risk tolerance, and craft a personalized asset allocation strategy and financial plan that aligns with your financial and emotional well-being. If you’re ready to take the next step in your financial journey, reach out to us.

Client Login

Client Login