Dollar Cost Averaging – Listen to the full episode on the Podcast!

iTunes | Spotify | iHeartRadio | Amazon Music | Castbox

Investing can be a daunting task, especially with the myriad of strategies available and the constant fluctuations in the market. One approach, however, has stood the test of time due to its simplicity and effectiveness: Dollar Cost Averaging (DCA). This investment strategy involves regularly investing a fixed amount of money into a particular asset, regardless of its price at the time of purchase. Over time, this method aims to reduce the average cost of the investment and mitigate the impact of volatility. Today we’ll dive into the intricacies of DCA, its benefits, and how it can be implemented in various investment scenarios.

Understanding Dollar Cost Averaging

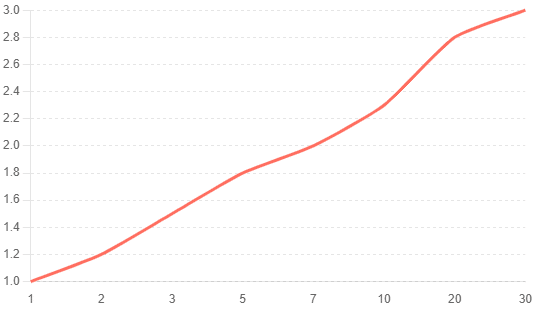

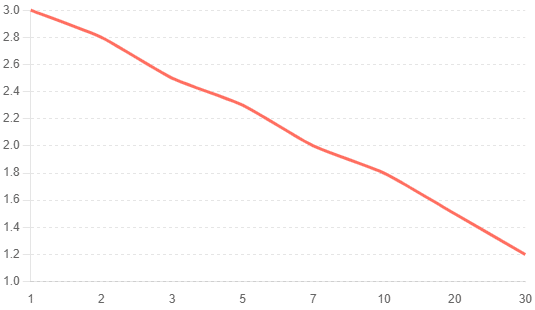

At its core, Dollar Cost Averaging is a disciplined investment approach that removes the emotional element from investing. By committing to invest a set amount of money at regular intervals, investors can avoid the pitfalls of trying to time the market, which is notoriously difficult even for seasoned professionals. Instead of making lump-sum investments that might coincide with market highs or lows, DCA ensures that investors buy more shares when prices are low and fewer shares when prices are high. This gradual accumulation can result in a lower average cost per share over time.

How DCA Works in Practice

To illustrate how DCA works, let’s consider a simple example. Imagine you decide to invest $500 each month in a mutual fund. In January, the share price of the mutual fund is $10, so you purchase 50 shares. Next month, the share price drops to $8, allowing you to buy 62.5 shares. Then, in March, the price rises to $12, and you purchase 41.67 shares. Over these three months, you have invested $1,500 and acquired 154.17 shares. The average cost per share is approximately $9.73, which is lower than the highest price paid ($12) during this period.

Benefits of Dollar Cost Averaging

- Reduces Market Timing Risk: One of the most significant advantages of DCA is that it eliminates the need to time the market. Investors often struggle with the fear of buying at the wrong time, especially when markets are volatile. DCA ensures that investments are made consistently, regardless of market conditions.

- Encourages Discipline: By committing to a regular investment schedule, investors develop a disciplined approach to investing. This discipline can prevent impulsive decisions driven by short-term market movements or emotional reactions to news events.

- Mitigates Volatility: Markets can be highly unpredictable, with prices fluctuating due to various factors. DCA helps smooth out these fluctuations by spreading investments over time. This approach reduces the impact of short-term market volatility on the overall investment.

- Simplifies Investing: DCA is straightforward to implement. Investors don’t need to constantly monitor the market or make complex decisions about when to buy or sell. The simplicity of this strategy makes it accessible to both novice and experienced investors.

Implementing DCA in Different Investment Accounts

Dollar Cost Averaging is a versatile strategy that can be applied to various types of investment accounts, including 401(k) plans, Individual Retirement Accounts (IRAs), and taxable brokerage accounts.

401(k) Plans

Many employees are already using DCA in their 401(k) plans, often without realizing it. When you contribute a portion of each paycheck to your 401(k), you’re effectively practicing DCA. These contributions are typically invested in a predetermined set of funds, such as target-date funds or mutual funds, based on your selected investment strategy. By consistently contributing to your 401(k), you leverage the power of DCA to build a substantial retirement nest egg over time.

Individual Retirement Accounts (IRAs)

DCA can also be effectively used in IRAs, whether traditional or Roth. Investors can set up automatic contributions from their bank accounts to their IRAs, ensuring regular investments. This approach allows you to take advantage of market fluctuations while steadily growing your retirement savings.

Taxable Brokerage Accounts

Beyond retirement accounts, DCA can be applied to taxable brokerage accounts. Investors can set up automatic transfers to their brokerage accounts and invest in a variety of assets, including individual stocks, mutual funds, or exchange-traded funds (ETFs). This strategy can be particularly beneficial for building a diversified portfolio over time.

For example, if you’re saving for a future real estate project or simply want to grow your wealth, you can set up a monthly contribution to your brokerage account. By investing in a diversified mix of assets, you can reduce the risk associated with market timing and benefit from the compounding effect of regular investments.

Advanced DCA Strategies

While the basic principle of Dollar Cost Averaging involves investing a fixed amount at regular intervals, there are some advanced strategies that investors can consider to enhance their returns.

Increasing Contributions Over Time

As your income grows or your financial situation improves, you may consider increasing your DCA contributions. For instance, if you receive a raise or a bonus, you can allocate a portion of that additional income to your investment accounts. This approach allows you to accelerate your wealth-building efforts and take advantage of higher market prices over time.

Adjusting Asset Allocation

Another advanced DCA strategy involves adjusting your asset allocation based on market conditions. While the core of your portfolio remains invested according to your long-term goals and risk tolerance, you can allocate a portion of your new contributions to more aggressive investments during market downturns. This contrarian approach can potentially enhance returns when the market recovers.

Combining DCA with Lump-Sum Investments

In some cases, investors may have a lump sum of money available for investment, such as an inheritance or a large bonus. Instead of investing the entire amount at once, you can combine DCA with lump-sum investments. For example, you might invest half of the lump sum immediately and spread the remaining half over several months using DCA. This hybrid approach balances the benefits of both strategies and reduces the risk of market timing.

The Psychological Benefits of DCA

Investing can be an emotional journey, with market volatility often triggering fear and anxiety. One of the less-discussed benefits of DCA is its positive impact on investor psychology. By adhering to a regular investment schedule, investors can avoid the stress of constantly monitoring the market and making decisions based on short-term fluctuations.

The “set it and forget it” nature of DCA provides peace of mind, as investors can trust that their money is consistently working for them. This long-term perspective helps investors stay focused on their goals and reduces the temptation to make impulsive decisions based on market noise.

Conclusion: The Timeless Appeal of Dollar Cost Averaging

Dollar Cost Averaging is a timeless investment strategy that offers numerous benefits for investors of all experience levels. Its simplicity, discipline, and effectiveness in mitigating market volatility make it an attractive approach for building wealth over time. Whether you’re contributing to a 401(k), an IRA, or a taxable brokerage account, DCA can help you navigate the complexities of the market and achieve your financial goals.

By committing to a regular investment schedule and avoiding the pitfalls of market timing, you can take advantage of the compounding effect and reduce the average cost of your investments. As you continue to invest, consider incorporating advanced DCA strategies to enhance your returns and further diversify your portfolio.

Remember, the key to successful investing is consistency and discipline. By embracing the principles of Dollar Cost Averaging, you can build a solid foundation for your financial future and enjoy the peace of mind that comes with a well-structured investment plan. For personalized advice on how DCA can benefit your unique situation, don’t hesitate to reach out to us at Bonfire Financial. Schedule a call today to get started.

Client Login

Client Login