The Power of 1%

How Small Changes Can Make Big Differences in your Retirement Plan

We have all heard that 1% better every day will have a massive effect on your life over the long run. How small changes can make big differences. It makes sense, if you could mathematically make yourself 1% better or more each day, you will be significantly better than you were at the beginning of the month or the beginning of the year. It is a worthy pursuit. But it is very hard to calculate unless you are talking about running miles or lifting weights.

The concept is that a small change over a long period of time will have a massive impact on you and your life if done for a long time. This can be applied to so many things. Even an aircraft that is 1 degree off will land in a very different location than what was scheduled. But today I want to apply it to your financial life. Specifically, your 401k or retirement plan.

The “Power of 1%” is a motivational abstraction, why would I want this idea applied to a boring, old 401k plan? Because just 1% could make a massive difference in your life. These small changes can make big differences in your retirement plan. This one concept could make your retirement and life unimaginably better, and totally change the way you grow your wealth. Just 1% can be the difference between barely scraping by, to being a comfortable millionaire.

The true key is to simply increase your 401k contribution by 1% at the beginning of the year, each year.

Let’s talk about how.

You have a 401k retirement plan and let’s say you are saving a decent amount of your money at 5% of your income, and your employer is either matching your contribution or putting in a percentage of your salary, depending on where you work.

Let’s take three pilots for this example, each in different stages in their career. 1. Rookie 2. Senior FO 3. Fully Tenured Captain who was flying bi-planes back in the day (joking). Pay will remain the same for easy math.

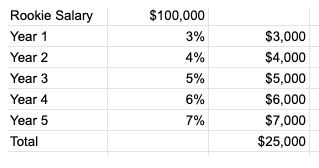

The Rookie makes $100,000 per year and is deferring 3% of his salary each year. In 5 years he would have put away $15,000 into his 401k. 3% seems like a lot, but over 5 years, that is only $15,000 for his retirement. Now let us see what would happen if he increases his deferral by just 1% each year. If he starts at 3% and increases each year by 1%, he will be at 7% (Year 1 was 3%) and over that time he would have contributed a total of $25,000! That is an extra $10,000 or 67% more than what he was normally doing.

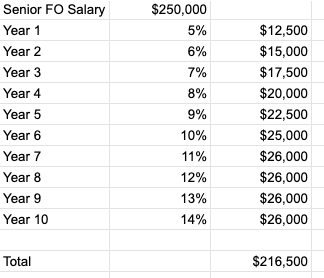

The Senior FO makes $250,000 per year and is deferring 5% into his 401k each year. When he retires in 10 years, he would have contributed $125,000 into his 401k. Not bad! But if he plans to retire, he should definitely do more. If he increased his contribution just 1% each year for 10 years, He would add $216,500 over his time, almost twice as much if he stuck with the 5% rate. Remember, you can only max out your side of the 401k contributions . But you can always take that money and put it somewhere else. (Hint, hint Backdoor Roth Conversions) Here is an example:

The last person is a Captain that will be retiring in 3 years. He has 3 years to put away as much money as possible. His salary is $350,000. He will need to put away 8% of his salary in order to meet his max. Since he doesn’t have a lot of time to scale up every percent, he should just try to contribute as much as possible before he retires. The more you can contribute to your 401k the better life will be.

The Tale of Two Pilots

Now let’s look at another example of how small changes can mean big differences in your retirement plan.

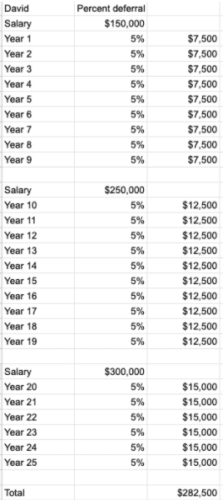

David and Susan both went to Metro State University to be pilots. They both were very good students, graduated from school, both worked for a regional liner and they just started flying for the same major airline. David loves to snowboard, vacation around the world, and party. He says “As long as I’m covering my financial bases, I can do the things I enjoy.”

Susan loves to ski, read books, and spend time with her family. Living a comfortable life is important for her and she wants to make sure she can do the things she enjoys in the future.

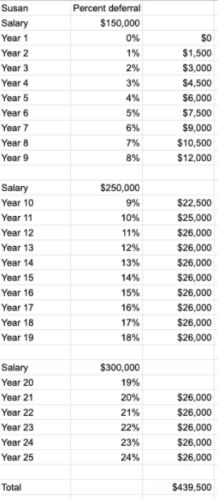

On their first day, they sit down with HR, and they are asked how much they want to start deferring in their retirement plan. David, whose friend told him to defer as much as he can, announces he will start with 5% of his $150,000 salary going to his 401k. When Susan sits down with HR, she says she can’t defer any dollars into her 401k because she wants to finish paying her student loans first. But she promises next year she will start with 1% of her $150,000. And the next year, 2% and so on.

At Year 10, they both start getting paid $250,000. And at Year 20, they are making $300,000.

25 years later, after they both have amazing and fulfilling careers, they bump into each other at the DIA breakroom! “Wow!” They say for they haven’t seen each other for a long time. After a while of catching up, they talk about their retirement accounts.

David smiles and boasts “I’ve been saving 5% of my salary since the first day I got here, and now I have saved $282,500 of my salary” as he calculates in his Excel spreadsheet:

“Very impressive!” Says Susan, as she tabulates how much she has saved. She started saving with nothing, but she promised she would increase her contribution by just 1% each year. After she does some math, she shows David how much she has saved. Smug David leans forward and stares, mouth open, at the numbers from Susan’s tablet…

“You saved $439,500?! Wow! I thought you said you were doing none, how did you beat me? That’s almost twice as much as I’ve saved, and I’ve been doing 5% my entire career!”

“Slow and steady wins the race” Susan smiled.

Just a small change can make a huge difference in your retirement plan. And just because you start off slow doesn’t mean you’re out. Don’t get discouraged, just try to be 1% better. Like Susan!

Check here for the most current 401(k) contribution limits

What’s Next?

If you are just starting out or in your mid-career, increasing your retirement plan contributions by just 1% this year will have a huge impact on your retirement accounts and life. This doesn’t even factor in the potential increased growth that your account could receive. Lastly, your salary regularly increases with inflation, usually around 2% to 3% each year. If you just took 1% from that, you would hardly notice the change in your cash flow.

This strategy is something relatively new but is gaining more traction among plan sponsors and large companies. Many of them are automatically enrolling employees into automatically increasing their deferral, or at least strongly encouraging their employees to increase their 401k contribution each year. Hopefully, these examples have made it clear the importance of growth for your retirement.

Do you have a financial plan? Interested to learn more about how you could maximize your 401(k)? Please reach out for a Free Strategy Call with our CERTIFIED FINANCIAL PLANNERS™ to help give you a clear path to a successful story. Susan would 🙂

Client Login

Client Login