IRA vs 401k: What’s the Difference:

There are some common misconceptions about the difference between an IRA (Individual retirement account) and a 401k plan. While these two are very similar there are some distinct differences that make each unique.

Before we tackle the difference between an IRA and a 401k it’s important to note that these are not investments. They are simply accounts. Just because you have an account open does not mean you have an investment that will grow and help fund your retirement. Much the same way that just because you own a refrigerator doesn’t mean you actually have any food in it. You have to add to it.

To continue with this analogy… in your fridge, you can have a variety of different types of food (juice, pickles, eggs, beer, and anchovies- if you’re into that sort of a thing). In an IRA and 401k you can have different investments too. Such as stocks, bonds, mutual funds, ETFs, commodities, real estate, and more. You can also change or “throw out” the investments in your IRA or 401k if you’ve left them in the back of the fridge for too long. You know like that 3lb. jar of mayo you bought for that party that one time.

Now that you are hungry, let’s get to the dive-in.

Overview of an IRA vs. 401K:

You probably know fundamentally that saving for retirement is one of the single best things you can do financially. You don’t want to rely on social security, you don’t want to run out of money, you don’t want to be a financial burden to your children, and you want to enjoy your golden years. All great reasons to have a retirement plan! So which retirement plan is best for you?

Both IRAs and 401Ks have tax benefits and are among the most common defined contribution plans. The good news is that you don’t have to choose one over the other. To maximize your retirement savings, you can and should, if possible, contribute to both an IRA and 401k.

The key to note is that a 401k, named for the section of the tax code that discusses it, is an employer-based plan and an IRA is an individual retirement plan. Got it?

First up let’s look at how a 401K and IRA are alike.

The Similarities:

- Both allow you to put money in on a tax-deferred basis. Meaning that taxes are not due at the time when you add money. For example, if you make $50,000 and decide to invest $2,000 of it into your IRA or 401k, the $2,000 is not going to be part of your taxable income.

- Your money within an IRA or 401k can be invested in a variety of ways.

- The money that is invested is allowed to grow tax-deferred. You do not have to pay taxes on the gains from your investments until you take the money out. If you make $1,000 off of your $2,000 investment, you now have $3,000 in your account and you will not have to pay taxes on that gain until you withdrawal the money.

- When you do withdrawal the money for whatever amount it will be considered part of your taxable income. You will own taxes on the withdrawal amount. Let’s say you withdrawal the $2,000 and your current annual income is $50,000 after the withdrawal your taxable income will be $52,000.

- Since an IRA and 401k are designed for retirement the money that you invest is not supposed to withdraw until after the age of 59 ½. You read that correctly -the government added in a half, well, because your inner 6-year-old knows it’s that important. If you withdraw the money prior to 59 ½ you will pay a 10% penalty on the money plus the amount withdrawn is now part of your taxable income.

- Also, the government mandates that at age 73 you have to take out a Required Minimum Distribution (RMD). Basically, they tell you the amount that you must pay taxes on. Quick note, if you are still employed at age 73 and not the owner of the company you can delay your RMDs.

The Differences:

While an IRA and a 401k have many similarities, they do differ in a few very key areas. The main one is that an IRA is an Individual Retirement Account, so it is yours and yours alone. Anyone can have one. A 401k is company-sponsored, so you can only participate in it if your employer offers one. Some other key differences are:

- Since a 401k is employer-sponsored, typically the employer will match a percentage of their employees’ contributions up to a certain limit or percentage. There is no option for this in an IRA.

- Consequentially because a 401K is employer-sponsored your investment options are limited to what the employer offers. Whereas an IRA will allow you to have more variety in terms of stocks, bonds, real estate, etc.

- Loan or hardship withdrawals are available for 401ks. However, IRAs generally do not permit loans or early withdrawals.

- An IRA has certain income limits and a 401k does not.

- Finally, the contribution limits are different and change from year to year. Feel free to give us a call to learn about the current years’ limits.

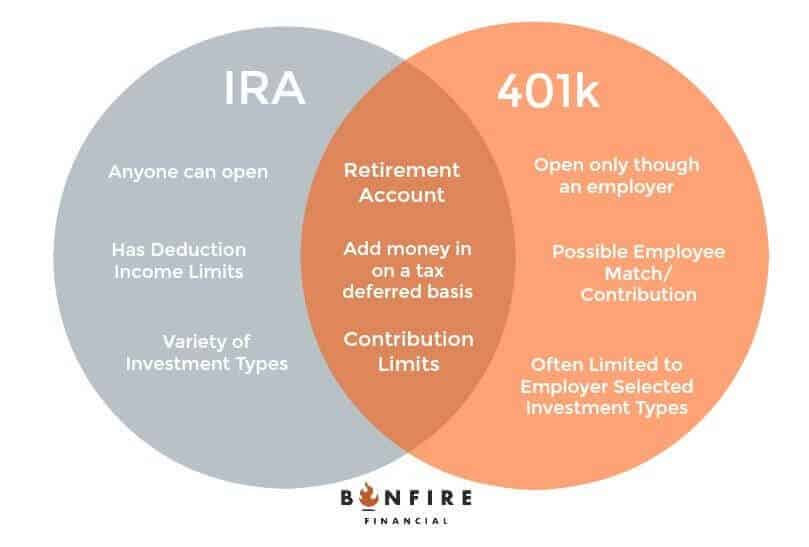

Difference Between an IRA and 401k- A Venn Diagram

Which is Right For You?

It depends really. If you have the option of putting your money into an employer-sponsored 401k or an IRA you should do both. Max them out if possible. We recommend prioritizing the 401k first especially if your employer offers a match and then adding to an IRA if you are within the income limits.

This hopefully gives you a good overview of the differences between an IRA and a 401k. While there are many factors to consider, the most important thing to remember is that both are great tools to use to help achieve your retirement goals.

Are you interested in learning about a Roth? We’ve got a great article here for you.

Have other questions? Please setup a call with us HERE!

Client Login

Client Login