Full Investment Review & Plan

Make sure your money is working as hard as you do. Our dynamic investment review and plan will help you make informed investment decisions, manage risk, and achieve your financial goals.

Savings Plan Strategy

Optimize how your money grows. Your savings plan strategy will help you develop strong financial habits and build long-term wealth while reducing financial stress.

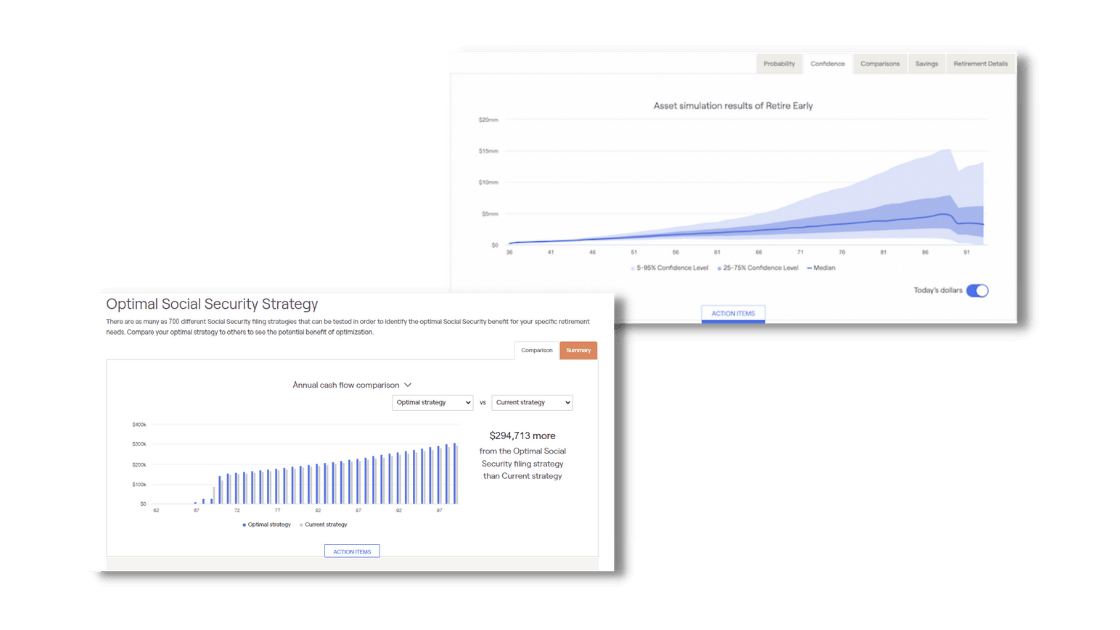

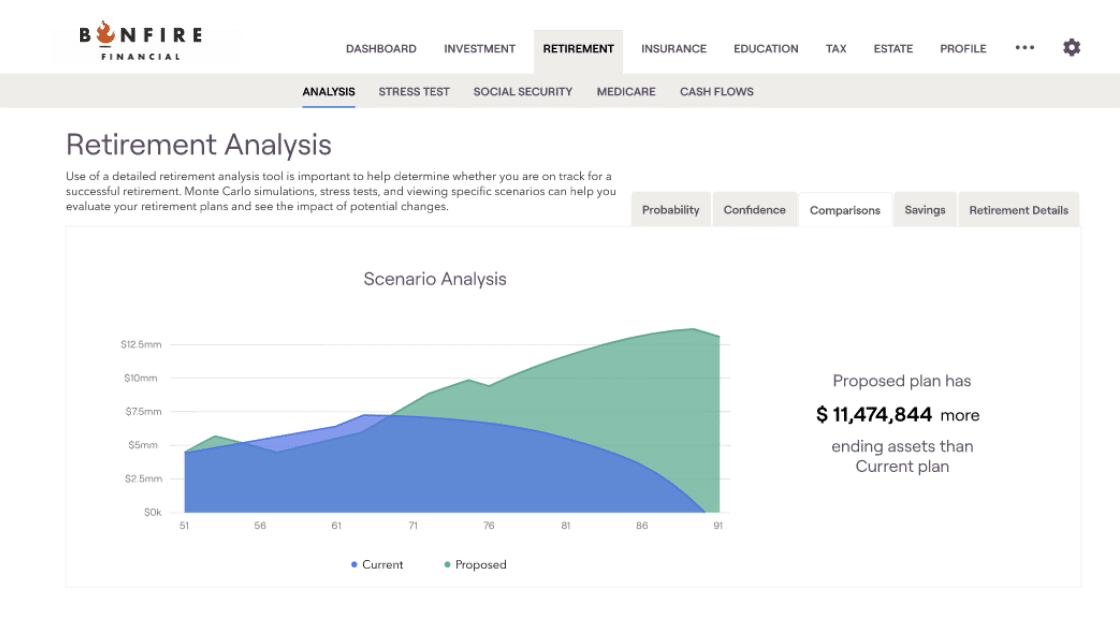

Retirement Analysis

Our interactive retirement analysis will illustrate multiple scenarios and stress tests to help guide your retirement planning decisions. You’ll get peace of mind knowing what steps to take.

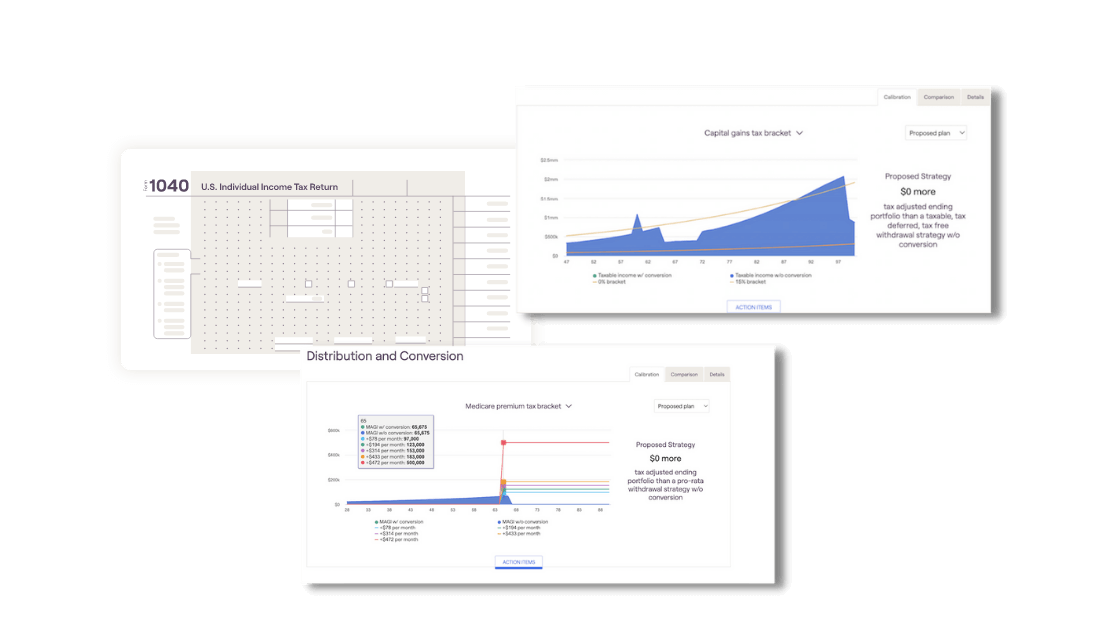

Cash Flow Strategy

A cash flow strategy will help you prioritize your financial goals and allocate resources accordingly. It will provide you with tax-efficient options.

Risk

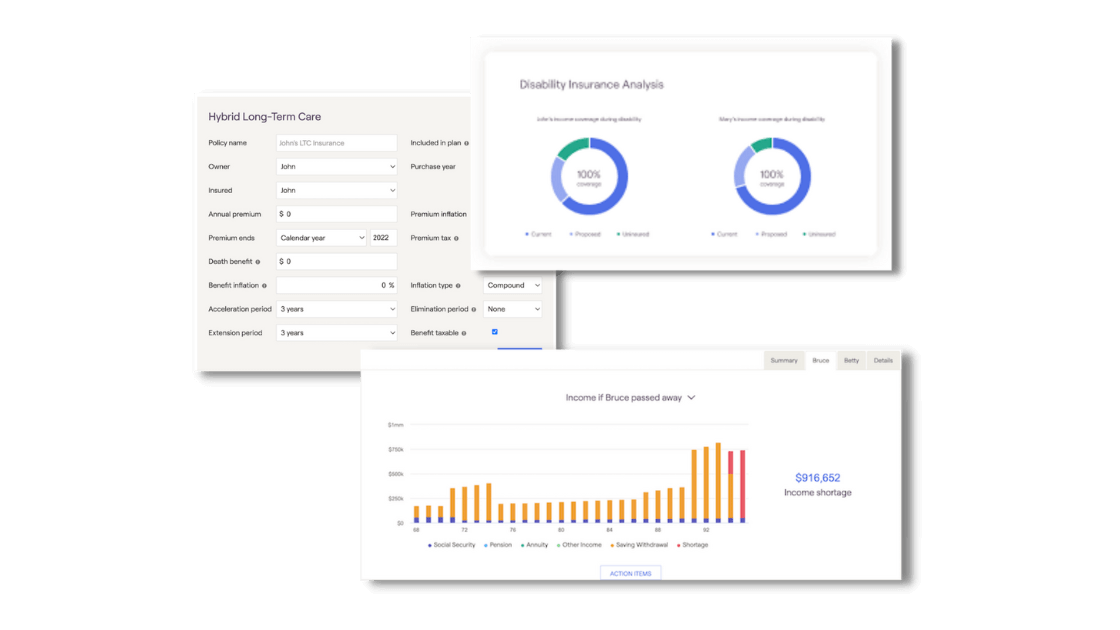

Review

Are you covered? Our risk review helps you identify potential risks, guide investment decisions, protect against unforeseen events, and provide peace of mind.

Financial Life Dashboard

Get a real-time overview of your entire financial life at your fingertips with our online financial dashboard. This robust software has everything you need to organize, plan and grow.

Investment Management

As your fiduciary, our CERTIFIED FINANCIAL PLANNER™ professionals design and actively manage a portfolio aligned with your goals. From stocks and bonds to Bitcoin and beyond, we oversee all aspects of your financial life with a disciplined, strategic approach. We meet with you regularly to ensure your investments stay on track—so you can focus on living, while we focus on managing your wealth.