Homeownership has long been a cornerstone of the American Dream, symbolizing stability, success, and financial security. For many, their home is the most significant asset they’ll ever own. As they approach retirement, the home equity they’ve built over the years can seem like a comforting safety net for retirement. However, relying on home equity as a primary component of your retirement strategy may not be as foolproof as it appears. Today we are exploring why it’s essential to rethink the role of home equity in your retirement planning and consider more reliable alternatives to ensure financial security in your golden years.

Listen anywhere you stream Podcasts:

iTunes | Spotify | iHeartRadio | Amazon Music

——

The Illusion of Home Equity as a Retirement Asset

At first glance, home equity seems like a robust financial resource. After all, if your home is fully paid off, you have a substantial amount of value tied up in that property. But this value is often more theoretical than practical when it comes to funding your retirement. Here’s why:

- Home Equity is Not Liquid: Unlike investments in stocks, bonds, or even cash, home equity is not readily accessible. To tap into it, you need to either sell your home or borrow against it. Both options come with significant drawbacks that can impact your financial security and quality of life during retirement.

- The High Cost of Downsizing: Many retirees consider downsizing as a way to unlock home equity. However, downsizing doesn’t always lead to a financial windfall. Housing markets fluctuate, and the costs associated with selling a home, purchasing a new one, and moving can eat into the equity you hoped to free up. Additionally, many retirees find that when they downsize in square footage, they end up upsizing in quality. Opting for newer or more luxurious homes may not save them much money after all.

- Borrowing Against Your Home: Home equity loans or lines of credit allow you to borrow against your home’s value, but this approach comes with risks. You’re essentially taking on debt at a stage in life when your income may be fixed or decreasing. Rising interest rates can make these loans more expensive, and if you’re unable to keep up with payments, you risk losing your home.

- The Psychological Value of Homeownership: There’s a strong emotional and psychological attachment to homeownership, especially in retirement. The idea of selling your home or taking on debt against it can feel unsettling for many people. Owning a home outright provides peace of mind. The thought of losing that security can be a significant barrier to making decisions that involve leveraging home equity.

Understanding the Role of Home Equity in Retirement Planning

While home equity may not be the financial windfall many expect in retirement, it does play a role in your overall financial picture. The key is to understand its place within a broader, diversified retirement strategy.

- Shelter as a Basic Need: At its core, home equity represents the value of the shelter it provides. Maslow’s hierarchy of needs places shelter as one of the most fundamental human necessities, alongside food and water. In retirement, having a paid-off home can significantly reduce your living expenses. You are no longer have a mortgage to pay. This stability is invaluable, but it’s important to recognize that the equity in your home is primarily tied to your ability to live there, rather than as a liquid asset you can easily access for other needs.

- Net Worth vs. Cash Flow: It’s important to distinguish between net worth and cash flow. Home equity contributes to your net worth, which looks great on paper, but it doesn’t directly contribute to your cash flow—the money you have available to spend on daily living expenses. In retirement, cash flow is critical. Having a high net worth due to home equity won’t help you pay for groceries, medical expenses, or travel..

- Strategic Use of Home Equity: For some retirees, there are strategic ways to use home equity that don’t jeopardize their financial security. For example, a reverse mortgage might be an option for those who need to access cash but have no intention of passing the home on to heirs. However, reverse mortgages are complex and can be risky. They typically involve selling the home’s equity to a lender in exchange for regular payments. It’s crucial to fully understand the implications before considering this option.

- Emergency Reserve: Instead of viewing home equity as a primary retirement asset, consider it as an emergency reserve. If unexpected expenses arise, or if your other retirement savings fall short, having the option to tap into home equity can provide a safety net. However, this should be a last resort rather than a cornerstone of your retirement plan.

Building a Comprehensive Retirement Strategy

Given the limitations of relying on home equity, it’s essential to build a comprehensive retirement strategy that incorporates multiple sources of income and assets. Here’s how to approach it:

- Diversified Investments: A well-diversified investment portfolio that includes a mix of stocks, bonds, and other assets can provide the cash flow you need in retirement. Unlike home equity, these assets can be more easily converted into cash and are designed to generate income over time.

- Retirement Accounts: Maximize contributions to retirement accounts such as 401(k)s, IRAs, and Roth IRAs. These accounts offer tax advantages and are specifically designed to provide income in retirement. The earlier you start contributing, the more time your investments have to grow.

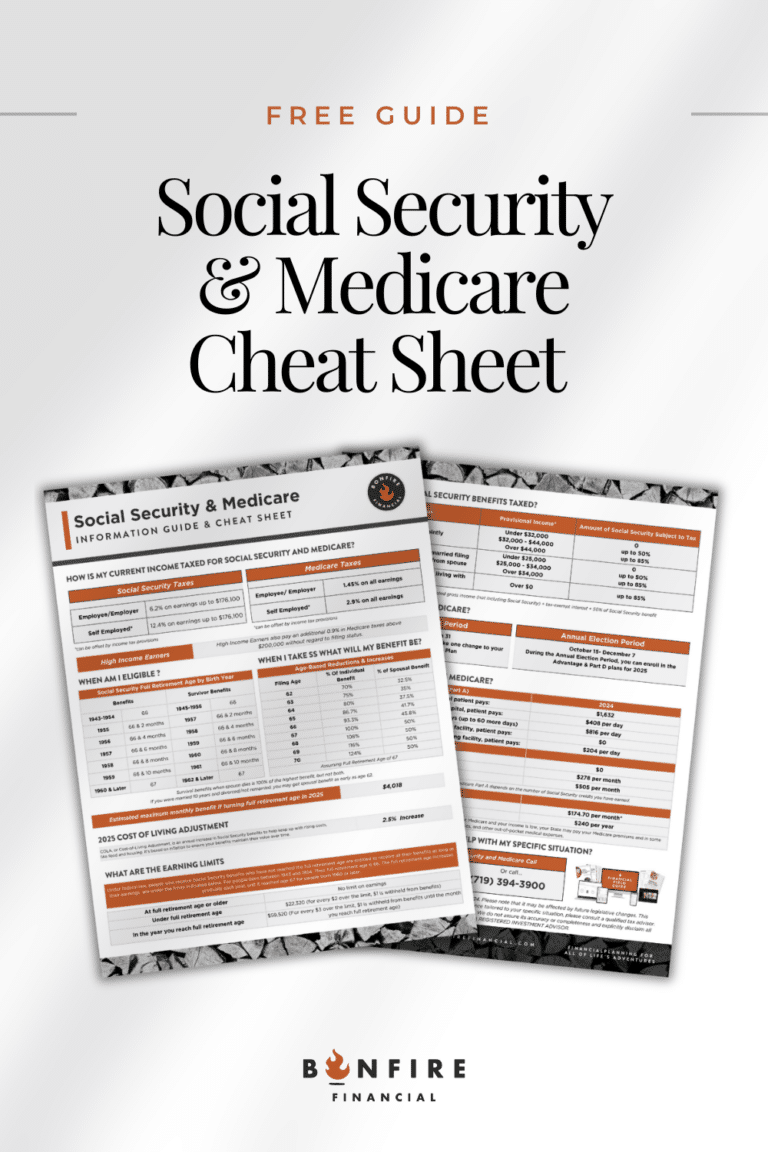

- Pension and Social Security: If you’re eligible for a pension or Social Security benefits, these can serve as reliable sources of income in retirement. It’s important to understand how these benefits work and how they fit into your overall plan. For example, delaying Social Security benefits can result in higher monthly payments

- Regular Financial Check-Ups: Retirement planning isn’t a one-time event. It’s important to regularly review and adjust your financial plan. You need to ccount for changes in the market, your health, and your lifestyle. Working with a financial planner can help you stay on track and make informed decisions.

Conclusion: Home Equity as Part of a Balanced Retirement Plan

Home equity can be a valuable component of your retirement plan. However, it’s crucial to understand its limitations and not rely on it as your primary source of income. By viewing home equity as a piece of the larger puzzle—rather than the entire solution—you can build a more secure and flexible retirement strategy that provides the cash flow and peace of mind you need.

If you’re unsure how to integrate home equity into your retirement plan or want to explore other options for securing your financial future, we’d love to have a conversation with you. We specialize in helping clients navigate the complexities of retirement planning, ensuring that all aspects of your financial life are aligned with your goals.

Ready to rethink your retirement strategy? Contact us today to start your personalized financial field guide and take the next step toward a secure and fulfilling retirement.

Client Login

Client Login