The shift into retirement is one of the most significant life transitions, yet it’s often overlooked as a time of emotional and mental adjustment. Moving from the routine of full-time work to living off savings and investments involves not just financial shifts but also psychological ones. Understanding and preparing for these changes can ease the transition and allow you to embrace this new phase of life fully.

Listen anywhere you stream Podcasts

iTunes | Spotify | iHeartRadio | Amazon Music

The Emotional Shift: Redefining Your Identity

For many, work is more than just a salary; it’s a core part of their identity. Retirement can create a sense of loss as you leave behind not only a job but also the structure, social connections, and sense of purpose it provides. These feelings are common and entirely normal.

To navigate this emotional transition:

- Find New Purpose: Look for activities that give your days meaning, such as volunteering, hobbies, or learning new skills.

- Stay Connected: Maintain and build social relationships to replace the daily interactions you had at work.

- Be Patient with Yourself: Adjusting to a new routine and identity takes time. Give yourself grace as you adapt.

The Financial Shift: From Paychecks to Portfolios

The financial aspect of shifting to retirement can feel like stepping into uncharted territory. During your working years, you rely on a steady income to cover expenses. As you shift into retirement, the focus shifts to drawing from savings, pensions, and investments to sustain your lifestyle.

This shift often brings about anxiety. The fear of running out of money or having to cut back on spending is common. To ease these concerns:

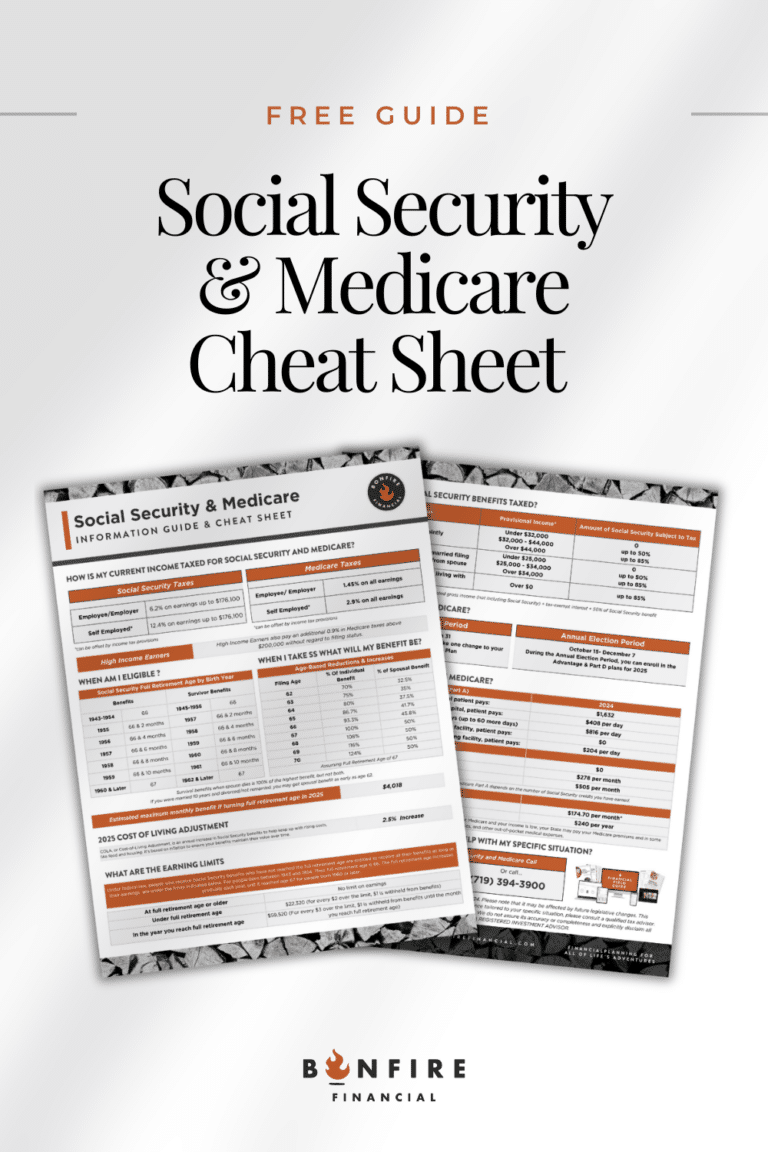

- Understand Your Income Sources: Know exactly where your retirement income will come from, such as Social Security, pensions, investment accounts, or rental properties.

- Create a Budget: Establish a clear picture of your living expenses and compare them to your expected income.

- Plan for Longevity: With people living longer, it’s crucial to ensure your savings last for decades. Work with a CERTIFIED FINANCIAL PLANNER™ to develop a sustainable withdrawal strategy.

Baby-Stepping Into Retirement

One of the best ways to transition smoothly into retirement is to take it step by step. Sudden changes can be overwhelming, but gradually adjusting your mindset and finances can make the process less daunting.

Start by simulating your retirement lifestyle:

- Test Your Budget: Try living on your projected retirement income for a few months while you’re still working. This will help you identify gaps and adjust your spending.

- Turn on Income Streams Gradually: Begin drawing from assets in phases to get comfortable with the new flow of money.

- Track and Adjust: Monitor your expenses and income during the first few months of retirement. Be flexible and make changes as needed.

Common Challenges and How to Overcome Them

While retirement is an exciting chapter, it’s not without its challenges. Recognizing these hurdles can help you prepare and tackle them with confidence.

- Fear of Overspending or Underspending: Many retirees worry about depleting their savings too quickly, while others underspend out of fear. Regularly reviewing your finances can provide clarity and peace of mind.

- Unexpected Expenses: Medical costs, home repairs, or family emergencies can strain your budget. Building a contingency fund into your retirement plan can mitigate these surprises.

- Lack of Routine: Without the structure of a work schedule, some retirees feel lost. Creating a daily routine that balances leisure, personal growth, and social activities can restore a sense of purpose.

Real-Life Example: A Gradual Transition

Consider a couple, Mark and Susan, who recently retired. Initially, they struggled with the idea of no longer receiving regular paychecks. They decided to approach their transition in stages:

- Simulated Budgeting: Six months before retiring, they began living solely off their projected retirement income to get a feel for their new lifestyle.

- Flexible Withdrawals: During their first year of retirement, they adjusted their monthly withdrawals based on actual spending, ensuring they neither overspent nor unnecessarily restricted themselves.

- Finding Purpose: Mark took up woodworking, a hobby he’d always wanted to explore, while Susan joined a book club and started volunteering at a local nonprofit.

By taking gradual steps, they eased their shift into retirement with confidence and now enjoy their newfound freedom without financial or emotional strain.

Tips for Thriving in Retirement

To make the most of your retirement years, focus on both financial stability and personal fulfillment:

- Stay Active: Regular exercise and mental stimulation are vital for long-term health and happiness.

- Keep Learning: Pursue new interests or continue education through courses, books, travel, or hobbies.

- Work with Experts: Partner with a financial planner to ensure your retirement plan is on track and adaptable to changes.

- Embrace Flexibility: Life is unpredictable, so build flexibility into your plans to accommodate unexpected twists and turns.

Conclusion: Embrace the Journey

Retirement is a significant transition, but it’s also a chance to craft the life you’ve always wanted. While the shift from a steady paycheck to living off your assets may seem intimidating, taking a gradual, flexible approach can ease the adjustment. By preparing financially and emotionally, you can fully embrace this new phase and enjoy the freedom and opportunities it brings.

If you’re ready to start planning your shift into retirement or need guidance navigating the transition, contact us at today! Our team is here to help you create a plan that ensures you’ll thrive in retirement.

Client Login

Client Login