When planning for retirement, the question often arises: Should I buy an annuity? Annuities are often touted as a reliable option for ensuring steady income during retirement, but they come with their own set of benefits and pitfalls. Today we exploring the different types of annuities, their pros and cons, and considerations to help you decide whether purchasing an annuity is the right choice for you.

Listen anywhere you stream Podcasts

iTunes | Spotify | iHeartRadio | Amazon Music

What is an Annuity?

An annuity is a financial product that provides a stream of income in exchange for an upfront lump-sum payment or a series of payments. Typically sold by insurance companies, annuities are popular for their ability to provide predictable income during retirement. They’re often used to safeguard against outliving your savings, ensuring you continue to receive income as long as you live.

Annuities are not a one-size-fits-all solution, and the details can be complex. There are various types of annuities, each with different features, benefits, and risks. To understand whether an annuity makes sense for you, it’s essential to familiarize yourself with the different options available and how they fit into your overall financial plan.

Types of Annuities

1. Immediate vs. Deferred Annuities

- Immediate Annuities: With an immediate annuity, you pay a lump sum to an insurance company, and in return, you start receiving income payments right away. These are ideal if you need an immediate income stream, for instance, soon after retirement.

- Deferred Annuities: Deferred annuities allow you to invest money and defer income payments until a future date. The money you invest grows tax-deferred, which means you’re not paying taxes on the growth until you begin to withdraw income. This type of annuity is suitable for those who want to save for future income.

2. Fixed, Variable, and Indexed Annuities

- Fixed Annuities: These offer a guaranteed interest rate for a specific period, providing a stable, predictable income stream. They’re one of the safest annuity options, but their returns may not keep up with inflation.

- Variable Annuities: Variable annuities allow you to invest in a range of sub-accounts, similar to mutual funds. The income you receive varies depending on the performance of these investments, so while there is potential for higher returns, there is also a risk of losing money.

- Indexed Annuities: Indexed annuities are tied to the performance of a stock market index like the S&P 500. They offer a guaranteed minimum return while allowing you to benefit from some of the market’s upside. However, there are usually caps and participation rates that limit how much of the market’s gains you receive.

The Pros and Cons of Annuities

Pros

- Guaranteed Income: One of the most appealing features, when you buy an annuity, is the ability to provide guaranteed income for life, which can be particularly comforting during retirement when the concern of outliving savings is common.

- Tax-Deferred Growth: Deferred annuities offer tax-deferred growth, meaning you don’t pay taxes on your investment earnings until you start taking withdrawals. This can be advantageous for individuals in high tax brackets during their working years.

- Peace of Mind: With an annuity, there’s a level of certainty that comes from having a steady income source. This peace of mind is valuable, especially when market volatility creates uncertainty around other investments.

- Inflation Protection: Some annuities offer riders that adjust your income for inflation, ensuring your purchasing power doesn’t erode over time. This feature can be especially important for maintaining quality of life during a lengthy retirement.

Cons

- High Costs: Annuities can be costly. Between administrative fees, mortality and expense (M&E) charges, investment management fees, and other potential costs, the expenses can significantly eat into your returns. Fees are often embedded into the contract and may be difficult to fully understand.

- Complexity: Annuities are notorious for being complex products. The contracts are often filled with legal and financial jargon, making it challenging for investors to understand all the terms. Hidden fees or stipulations can lead to unpleasant surprises down the road.

- Lack of Liquidity: Once you purchase an annuity, it’s challenging to access your principal without facing substantial penalties, particularly during the early years of the contract. The illiquid nature of annuities makes them a poor choice for those who need easy access to their funds.

- Surrender Charges: Most annuities come with a surrender period—a set number of years during which you must pay a penalty if you want to withdraw more than a certain amount of money. These penalties can be quite steep, often 7-10% in the early years of the annuity contract.

- Credit Risk: Unlike bank products insured by the FDIC, annuities are backed by the financial strength of the issuing insurance company. If the insurer goes under, there’s a risk you might not receive the income promised, although state guaranty associations provide some protection.

Should I Buy an Annuity?

The question of whether you should buy an annuity is highly individual and depends on your personal financial situation, goals, and comfort with risk. To make this decision, you’ll need to weigh several factors.

1. What Are Your Retirement Income Needs?

If you’re looking to supplement Social Security or pension income to cover essential living expenses, an annuity might be a good fit. Annuities provide a reliable source of income that can cover the gap between your guaranteed income and your required living expenses.

2. How Comfortable Are You with Complexity?

Annuities are not for everyone, and they require a certain level of financial understanding. If you’re uncomfortable with complexity or don’t have the time to do your due diligence, an annuity might not be ideal. Alternatively, working with a trusted financial advisor can help make the details more manageable.

3. Do You Value Security Over Growth?

Annuities are about security, not aggressive growth. If you are someone who is comfortable with market risk and are seeking the highest possible returns, annuities might not offer the growth potential you’re after. Mutual funds, ETFs, or stocks may be more aligned with your objectives if growth is your primary concern.

4. Are You Worried About Outliving Your Money?

One of the most significant risks in retirement is outliving your savings. An annuity can mitigate this risk by providing a lifetime income stream. If you’re concerned about longevity risk, an annuity could be a valuable tool to include in your retirement strategy.

Annuities vs. Other Investment Vehicles

Many people compare annuities to other retirement investment options, such as mutual funds, ETFs, or real estate. Below is a comparison of annuities and other popular retirement products to help you understand where they fit within a broader investment strategy.

Mutual Funds vs Annuities

- Risk: Mutual funds are inherently riskier than annuities because they are subject to market fluctuations. The returns can vary significantly depending on market conditions, whereas annuities often provide guaranteed income.

- Liquidity: Mutual funds are generally liquid, meaning you can sell your shares and access your funds easily. Annuities, on the other hand, lock your money away, often with penalties for early withdrawal.

- Cost: Mutual funds also have fees, but these are generally lower compared to annuities, which include multiple types of charges.

- Growth Potential: Mutual funds typically offer higher growth potential than annuities, which prioritize stability and guaranteed returns over market growth.

ETFs vs Annuities

- Investment Flexibility: ETFs offer more flexibility and lower fees, and they are ideal for investors looking to build diversified portfolios that can be easily managed.

- Income Guarantee: ETFs do not provide income guarantees—your investments will fluctuate with the market. Annuities provide a guarantee that ETFs cannot match.

- Cost and Complexity: ETFs are transparent and relatively straightforward, whereas annuities can be complex and laden with fees.

Real Estate vs Annuities

- Income Stability: Annuities offer predictable, steady income, whereas real estate income can fluctuate depending on factors like vacancy rates, repairs, and changing rental markets.

- Liquidity: Real estate is also not very liquid, similar to annuities, but it may provide growth in value over time, whereas annuities generally do not appreciate.

- Management: Real estate requires active management, which can be time-consuming, whereas annuities are entirely hands-off after the initial purchase.

How to Buy an Annuity

If you’ve determined that an annuity is the right choice for you, it’s crucial to understand how to go about purchasing one.

- Work with a Licensed, CERTIFIED FINANCIAL PLANNER™: Annuities are complex products, and a financial advisor can help navigate the various options to find the best fit for you.

- Understand the Fees: Always ask about fees and charges upfront. Look for the total cost of the annuity, including administrative fees, M&E fees, and rider charges.

- Read the Contract Thoroughly: Annuities come with lengthy contracts. It’s essential to read the fine print or have an expert review the contract to understand what you are getting into.

- Consider the Issuer’s Financial Strength: Since an annuity is backed by the insurance company issuing it, make sure the insurer has a strong credit rating. You want an issuer that will still be around decades from now.

Key Takeaways

- Annuities provide guaranteed income, making them suitable for individuals looking for safety and stability in retirement.

- They are often complex and can be expensive, with fees that are sometimes hidden within lengthy contracts.

- Annuities are not as liquid as other investments and are best suited for those who do not need quick access to their principal.

- If you value guaranteed income and are concerned about outliving your savings, annuities can be a valuable part of your retirement portfolio.

- Always read the contract before you buy an annuity, understand the fees, and work with a trusted advisor to ensure you are making the right decision.

The decision to purchase an annuity comes down to your financial goals, your understanding of the product, and your risk tolerance. By carefully evaluating your options and considering your long-term needs, you can make an informed decision that supports a comfortable retirement.

Next Steps

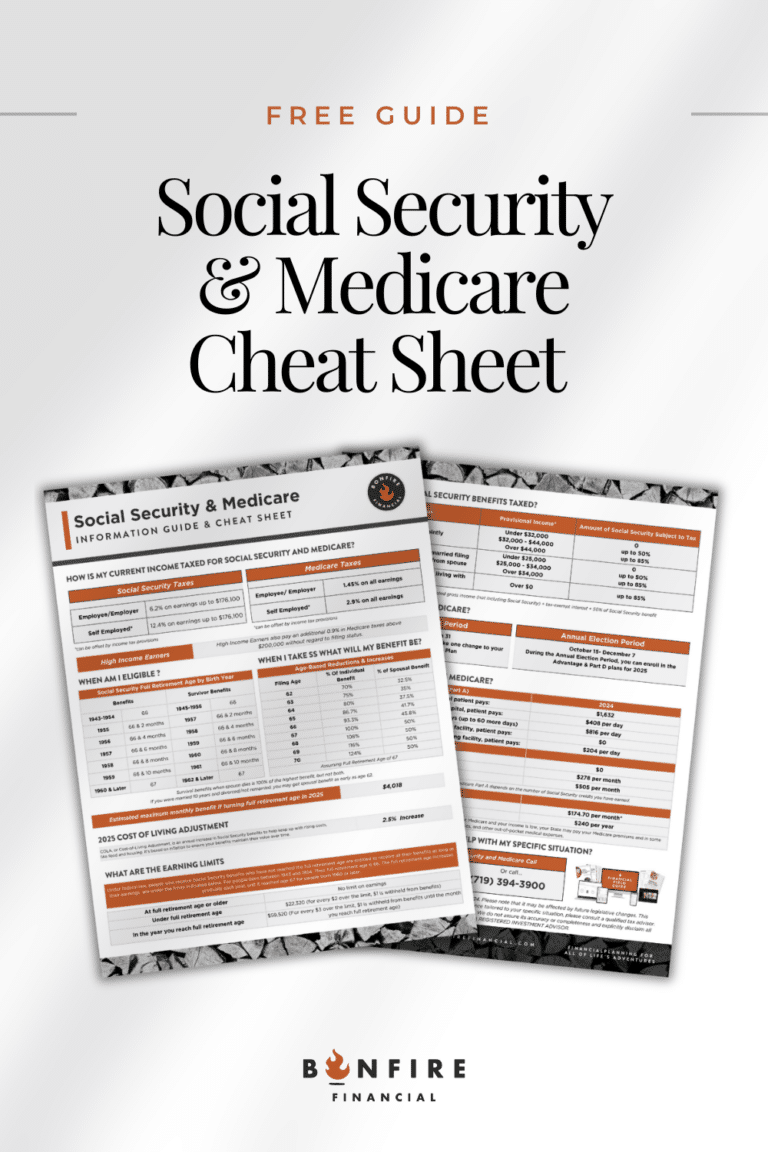

So, should you buy an annuity? The answer depends on what you’re looking for: stability and guaranteed income or growth and flexibility. Take your time, do your homework, and consult a professional—it could make all the difference in securing your financial future. Want a professional opinion on your specific situation? Set up a call with us today!

Client Login

Client Login