Qualified vs. Non-Qualified Accounts?

The account type you choose could change your tax bill, and your retirement timeline.

Understanding how your investments are taxed isn’t just for accountants. It’s one of the most important pieces of your long-term financial picture. The truth is, not all investment accounts are created equal, and the difference between qualified and non-qualified accounts can have a big impact on how much you keep and how much goes to the IRS.

Today we’ll break down what each account type means, how they’re taxed, when you can access your money, and how a well-balanced mix can set you up, on your own timeline.

Listen Now: iTunes | Spotify | iHeartRadio | Amazon Music

What Is a Qualified Account?

Let’s start with the basics.

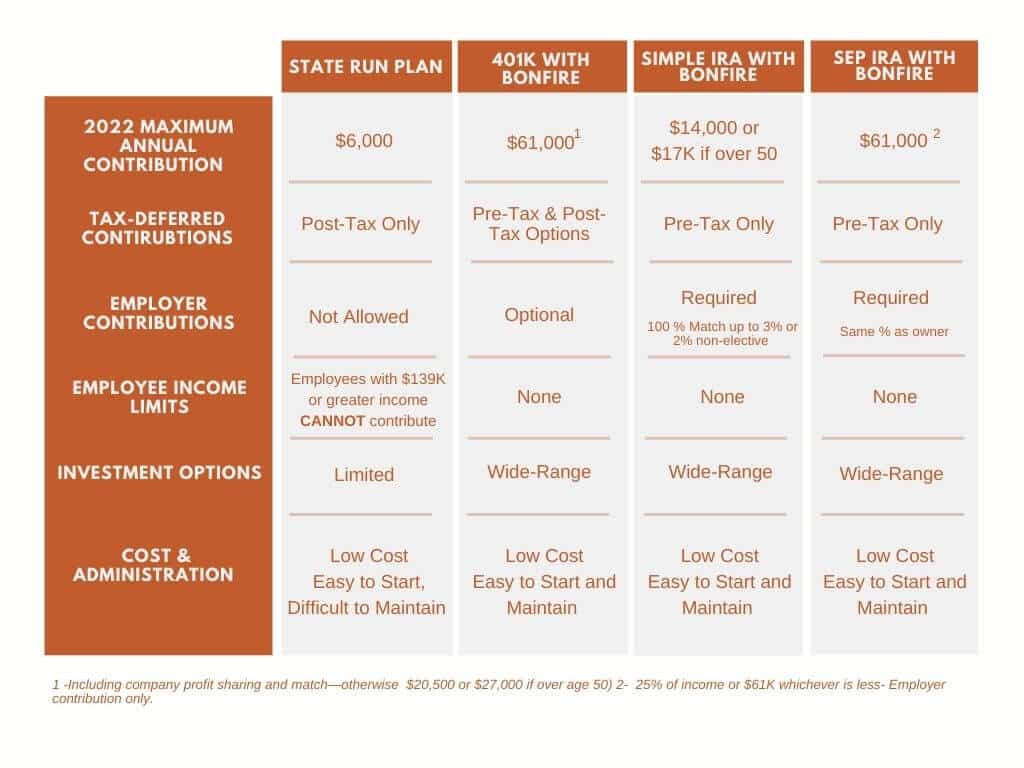

A qualified account is a retirement account that meets specific IRS rules to receive tax advantages. Think of these as the “officially recognized” retirement savings vehicles like your 401(k), Traditional IRA, Roth IRA, SIMPLE IRA, or SEP IRA.

The key benefits?

-

You might receive a tax deduction on your contributions.

-

Your investments grow tax-deferred (or tax-free in the case of Roth accounts).

-

You may be eligible for employer matching in workplace plans.

These accounts are designed to help you save for the long term. The IRS offers these benefits to encourage people to plan for retirement, but in exchange, there are rules about when and how you can access the money.

How Qualified Accounts Are Taxed

In most qualified accounts, you’re either deferring taxes until later or paying them upfront for future tax-free growth.

Here’s the quick breakdown:

| Type of Account | When You Pay Taxes | Tax Advantage |

|---|---|---|

| Traditional 401(k) / IRA | When you withdraw | Contributions reduce your taxable income today; growth is tax-deferred |

| Roth 401(k) / IRA | Before you contribute | Withdrawals in retirement are tax-free (if rules are met) |

When you eventually take money out, typically in retirement, it’s taxed as ordinary income. That means the withdrawals get added to your income for that year and taxed at your marginal rate.

There are also Required Minimum Distributions (RMDs) for most qualified accounts, starting at age 73 (for most individuals). The government wants its share eventually.

Withdrawal Rules

The biggest limitation of qualified accounts is accessibility. The IRS designed them for retirement, so you can’t typically touch the money until age 59½ without paying penalties. Withdraw early, and you’ll likely face:

-

10% early withdrawal penalty

-

Income tax on the amount you take out (unless it’s a Roth contribution)

There are exceptions, for example, certain first-time home purchases, education expenses, or hardship withdrawals, but for most investors, it’s best to view these accounts as untouchable until retirement.

What Is a Non-Qualified Account?

Now let’s look at the other side of the coin.

A non-qualified account is any investment account that isn’t registered under a retirement plan. It’s funded with after-tax dollars, meaning you don’t get a deduction for contributing, but you gain flexibility.

Examples include:

-

Brokerage accounts

-

Trust accounts

-

Individual or joint investment accounts

There’s no contribution limit, no withdrawal restriction, and no early penalty for accessing your money. You can invest as much as you want, whenever you want, and withdraw it at any time.

The trade-off? You’ll pay taxes on your earnings as they happen.

How Non-Qualified Accounts Are Taxed

Here’s where it gets interesting, and where many investors get tripped up.

In a non-qualified account, you’ve already paid taxes on the money you put in. You won’t be taxed again on your original investment. But you will owe taxes on the growth, the profits your money earns through dividends, interest, or capital gains.

Let’s use an example:

You invest $100,000 in a brokerage account. Over time, it grows to $150,000.

-

Your original $100,000 has already been taxed.

-

The $50,000 gain is what’s subject to tax.

How much you pay depends on how long you held the investments and what type of income it generated.

| Type of Gain | Holding Period | Taxed As |

|---|---|---|

| Short-Term Capital Gains | Less than 1 year | Ordinary income (your regular tax rate) |

| Long-Term Capital Gains | More than 1 year | 0%, 15%, or 20%, depending on income |

| Dividends / Interest | Varies | Typically ordinary income or qualified dividend rate |

Flexibility and Liquidity

The beauty of non-qualified accounts is access. You don’t have to wait until you’re 59½ to use the money. That makes these accounts especially useful if you plan to retire early, buy a property, or fund a child’s education before your official retirement age.

They also provide a way to keep investing after you’ve maxed out your qualified accounts. For clients striving for financial independence before 65, non-qualified accounts are often the bridge between the working years and full retirement.

Taxes in Motion: Comparing the Two

Think of the difference like this:

-

Qualified accounts are “pay later.” You get a tax break now, but pay taxes when you withdraw.

-

Non-qualified accounts are “pay as you go.” You pay taxes on the earnings each year, but enjoy flexibility and liquidity.

Here’s a side-by-side summary:

| Feature | Qualified Account | Non-Qualified Account |

|---|---|---|

| Tax Treatment | Tax-deferred or tax-free (Roth) | Earnings taxed annually |

| Contribution Limits | Yes (e.g., $23,000 for 401(k) in 2025) | None |

| Withdrawal Rules | Restricted until age 59½ | Withdraw anytime |

| Penalties | Possible early withdrawal penalties | None |

| Required Minimum Distributions | Yes | No |

| Ideal For | Long-term retirement savings | Flexible, mid-term, or early-retirement goals |

The Strategy Behind Both

Having both types of accounts is like having different tools in a toolbox. Each serves a purpose depending on your financial goals and timeline.

1. Tax Diversification

Just as you diversify your investments, you should also diversify your tax exposure. When you have both account types, you can strategically decide where to withdraw from each year to minimize taxes in retirement.

For example:

-

In years when your income is lower, you can withdraw from qualified accounts at a lower tax rate.

-

In higher-income years, you can rely more on non-qualified accounts or Roth assets, avoiding additional taxable income.

That’s what we call tax-efficient retirement income planning.

2. Tax-Loss Harvesting

One of the most talked-about strategies in non-qualified accounts is tax-loss harvesting, the art of turning market dips into potential tax savings.

If you sell an investment at a loss, you can use that loss to offset gains elsewhere in your portfolio. If your losses exceed your gains, you can even use up to $3,000 to offset ordinary income, carrying the rest forward for future years.

It’s not always fun (because it means something went down), but it’s a smart way to make volatility work for you.

Remember: tax-loss harvesting only applies to non-qualified accounts, not to IRAs or 401(k)s, because those are tax-sheltered until you withdraw.

3. Borrowing Against Your Investments

This is a little-known but powerful strategy.

In a non-qualified account, you can borrow against your portfolio using an asset-based line of credit.

For example, if you hold $500,000 in appreciated stock, you could borrow against it for liquidity,say, for a real estate purchase—without selling the stock or realizing a taxable gain.

The stock remains your collateral, your investments stay intact, and you get access to cash when needed. This is often how high-net-worth investors fund major purchases tax-efficiently.

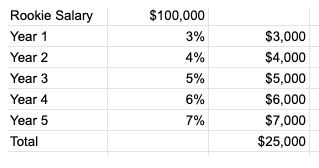

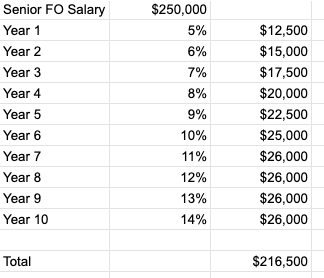

4. Planning for Early Retirement

If your goal is to retire before 59½, non-qualified accounts are essential. While qualified plans are excellent for long-term growth, they’re not designed for early withdrawals. Having a healthy non-qualified balance gives you bridge money to cover the years before you can access your retirement accounts penalty-free.

That flexibility can make the difference between retiring at 55 and waiting until 65.

Qualified vs. Non-Qualified Account Comparision

Common Mistakes to Avoid

Even experienced investors can make missteps with how they use their accounts. Here are a few pitfalls to watch for:

-

Overfunding one account type.

Putting every dollar into your 401(k) can leave you “asset rich but cash poor” if you want to retire early. -

Ignoring tax consequences of trading.

Frequent buying and selling in a non-qualified account can create unnecessary short-term gains. -

Not planning withdrawals strategically.

Taking all income from one source in retirement can push you into higher tax brackets. -

Neglecting beneficiary designations.

Qualified and non-qualified accounts can pass differently to heirs—another reason to coordinate your estate plan.

Building a Balanced Financial Plan

The most effective financial strategies don’t rely on a single type of account, they blend them intentionally.

At Bonfire Financial, we help clients balance qualified vs. non-qualified accounts based on their goals, income, and retirement vision. For some, that means prioritizing 401(k) contributions for the tax deduction. For others, it’s about maximizing brokerage savings for flexibility and access.

The right mix depends on:

-

Your income level (and current tax bracket)

-

Your retirement timeline

-

Your desired lifestyle before and after 59½

-

Your comfort with market risk and liquidity

By coordinating both account types, you can minimize lifetime taxes, maintain flexibility, and design a strategy that adapts as your life changes.

The Big Picture

At the end of the day, qualified vs. non-qualified isn’t a competition, it’s a collaboration.

Qualified accounts help you build a tax-deferred foundation for the long haul. Non-qualified accounts give you the agility to handle life’s changes along the way.

When you understand how these accounts work, and more importantly, how they work together, you can make smarter decisions that keep more money in your pocket and help you retire on your terms.

Final Thoughts

The account type you choose truly can change your tax bill, and your retirement timeline. But you don’t have to figure it out alone. The best strategies are built around your specific goals, lifestyle, and timeline.

If you’re ready to make your money work harder, and smarter, for you, our team at Bonfire Financial can help you create a plan that balances tax efficiency, liquidity, and long-term growth.

→ Schedule a meeting with us to start building your personalized investment strategy.

Client Login

Client Login