As retirement approaches, the way you manage your 401k becomes more critical than ever. With the right strategies, you can protect your hard-earned savings, minimize risks, and set yourself up for a comfortable retirement. In this Podcast, we’ll explore essential do’s and don’ts for managing your 401k as you near retirement, helping you make informed decisions about your financial future.

Listen anywhere you stream Podcasts

iTunes | Spotify | iHeartRadio | Amazon Music

1. Understand How Your Risk Tolerance Changes Near Retirement

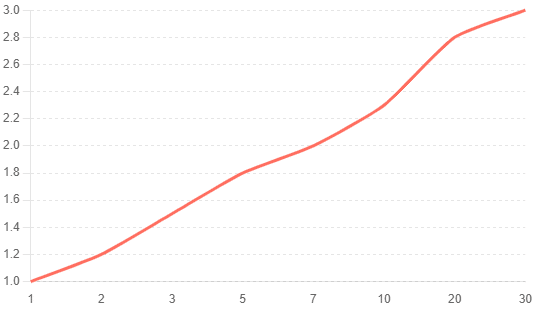

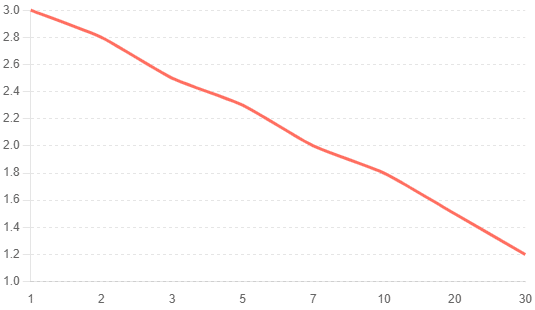

Don’t assume your risk tolerance remains the same as you age. When you’re younger, it’s easier to take on higher risk for the potential of higher returns, as you have more time to recover from any downturns. However, as you approach retirement, you should reevaluate your tolerance for risk.

Do consider shifting towards a more conservative investment strategy. This could involve reallocating your assets to include more bonds or other fixed-income securities, which tend to be less volatile than stocks. Target-date funds, which automatically adjust your investment mix as you age, can be a convenient way to ensure your portfolio becomes more conservative over time.

2. Avoid Overly Aggressive Investments

It can be tempting to chase high returns, especially if you’re trying to catch up on retirement savings. However, overly aggressive investments can expose you to significant losses, especially if there’s an economic downturn close to your retirement date.

Don’t let short-term market trends drive your decisions. Avoid investing heavily in high-risk stocks based on recent performance. The market’s past performance doesn’t guarantee future results, and downturns can occur suddenly.

Do seek a balanced portfolio that aligns with your updated risk tolerance. Consider consulting a CERTIFIED FINANCIAL PLANNER™ to review your portfolio and ensure it aligns with your long-term goals and timeline. This can help protect you from the emotional impulse to sell during market dips or take unnecessary risks.

3. Keep Contributing to Your 401k

Many people assume they should stop contributing to their 401k once they hit a certain age, but there are often advantages to continuing to save. The closer you get to retirement, the more crucial these contributions become.

Do take advantage of catch-up contributions if you’re over 50. These allow you to contribute additional funds beyond the standard annual limit, giving you a boost in retirement savings. Make the most of your employer’s match as well, as this is essentially free money going into your retirement fund.

Don’t assume that just because retirement is near, saving becomes less important. Every contribution counts, as it not only grows through investment returns but also helps keep you on track with your financial goals.

4. Regularly Rebalance Your Portfolio

Over time, certain investments in your portfolio may grow faster than others, leading to an unintended imbalance in your asset allocation. This can increase your risk exposure if, for instance, stocks outperform bonds, making equities a larger portion of your portfolio than originally intended.

Do rebalance your portfolio at least once a year to ensure it aligns with your target asset allocation. As you approach retirement, your target asset allocation will likely lean more toward stability and income generation rather than growth. By rebalancing, you can reduce your risk and bring your portfolio back in line with your retirement goals.

Don’t ignore market fluctuations. By rebalancing, you’re essentially selling high and buying low, which can be a disciplined approach to investing. If you’re unsure how to rebalance your portfolio, a financial advisor can help you assess and adjust your asset allocation as needed.

5. Be Cautious with Annuities

Annuities can be an attractive option because they offer guaranteed income. However, they are not a one-size-fits-all solution and can come with high fees and complex terms.

Don’t buy an annuity without fully understanding how it works and whether it’s appropriate for your situation. Some advisors may push annuities due to the commissions they receive, but that doesn’t mean it’s the right choice for everyone. Annuities can limit your liquidity and may have penalties for early withdrawal.

Do consider an annuity if it aligns with your overall retirement plan and you’re looking for a stable income source. Work with an advisor who will explain the pros and cons without a bias toward selling you a specific product. Annuities might be suitable in situations where you need a guaranteed income stream, but it’s essential to weigh the costs and benefits carefully.

6. Make Tax-Efficient Withdrawals

When you start withdrawing from your 401k in retirement, you’ll need to pay income taxes on the distributions. Depending on your total retirement income, these withdrawals could push you into a higher tax bracket. See what tax bracket you are in here.

Do plan your withdrawals strategically to minimize your tax burden. If you have other retirement accounts, such as a Roth IRA, consider taking distributions from them in a way that helps you manage your tax liability. For example, withdrawing from a traditional 401k and a Roth IRA in the same year can help you stay within a lower tax bracket.

Don’t withdraw large sums from your 401k in a single year unless necessary. Large withdrawals can trigger higher taxes and potentially Medicare surcharges. By managing your withdrawals thoughtfully, you can stretch your savings further and avoid paying more tax than necessary.

7. Consider the Role of Social Security

For many retirees, Social Security forms a crucial part of their retirement income. However, when and how you claim these benefits can significantly impact the amount you receive over your lifetime.

Do research the optimal age to start claiming Social Security based on your situation. While you can start as early as age 62, waiting until full retirement age (or even age 70) increases your monthly benefit. If you’re married, coordinating benefits with your spouse can also maximize your household income.

Don’t overlook Social Security as a part of your retirement plan. It’s essential to understand how your 401k distributions and Social Security benefits work together. A well-planned approach to claiming Social Security can help ensure you get the most out of your retirement income sources.

8. Review Beneficiary Designations

Life changes, such as marriage, divorce, or the birth of a child, may impact whom you want to inherit your 401k savings. Your retirement accounts don’t pass through your will but are instead directed by the beneficiary designations on the account.

Do periodically review and update your beneficiary designations to ensure they reflect your current wishes. This is a simple task but can prevent potential disputes or complications for your heirs. Make sure your beneficiaries are aware of their status, so they know what to expect.

Don’t assume that your will covers your 401k. Many people make this mistake and inadvertently leave their retirement savings to the wrong person. By keeping your beneficiary designations up to date, you can avoid this oversight.

9. Work with CERTIFIED FINANCIAL PLANNER™ (CFP)

As you get closer to retirement, your financial decisions become more complex. It can be challenging to navigate investment choices, tax implications, and withdrawal strategies without professional guidance.

Do consider consulting a CERTIFIED FINANCIAL PLANNER™ (CFP) who specializes in retirement planning. A CFP can provide personalized advice that considers your entire financial picture and helps you create a tailored strategy for your 401k and other retirement assets.

Don’t go it alone, especially if you feel uncertain about any aspect of your retirement planning. The insights and guidance of a professional can be invaluable, particularly as you make significant decisions that will impact your future financial security.

10. Stay Informed and Flexible

The financial landscape is always changing, with new laws, products, and strategies emerging regularly. As a retiree or soon-to-be retiree, staying informed can help you make better decisions and adapt to changing circumstances.

Do continue educating yourself on retirement topics, whether through podcasts, articles, or books. Financial literacy can help you feel more in control and make informed choices.

Don’t assume that your plan is set in stone. Flexibility is essential as you move through different stages of retirement. Regularly reviewing your plan and making adjustments as needed can help you stay on track.

In Conclusion

Planning for retirement involves more than simply building a nest egg. By paying attention to these 401k do’s and don’ts in retirement, you can make smarter choices about your savings, protect your assets, and set yourself up for a more secure retirement. Remember, retirement planning is an ongoing process, and the strategies that work for you today may need adjustment in the future. By staying proactive and seeking guidance when necessary, you’ll be well-equipped to make the most of your retirement years.

Next Steps:

Ready to take control of your retirement planning? Schedule a call with us today to discuss your 401k strategy and make sure you’re on the right path for a secure and comfortable retirement. Contact us at today.

Client Login

Client Login