In the most recent episode of The Field Guide Podcast host Brian Colvert is joined by Nick Coleman, a CERTIFIED FINANCIAL PLANNER™ with Bonfire Financial. Nick has developed a unique specialty in helping pilots navigate their financial planning journey. Below is a summary of the insights shared during the interview, highlighting the distinct financial challenges pilots face and the tailored strategies Nick employs to guide them from the runway to retirement.

Listen Now:

iTunes | Spotify | iHeartRadio | Amazon Music | Castbox

The Journey to Specialization

Nick’s journey into specializing in financial planning for pilots began with a personal connection. His father, Jerry Coleman, has been a pilot with United for over 30 years, with a prior career as a Navy pilot. This background gave Nick an intimate understanding of the unique benefits and challenges pilots encounter. Starting with his parents as his first clients, Nick quickly expanded his network, working with many pilots across various airlines, including United, Spirit, Southwest, and many others.

Unique Challenges Pilots Face

Pilots have a distinct set of financial planning challenges compared to other professionals. The path to becoming a pilot involves significant time and financial investment. It often takes around ten years, whether through the military or commercial route, to reach a major airline. Once there, pilots face industry volatility, with crises emerging approximately every ten years. Events like the COVID-19 pandemic have led to hiring freezes, early retirements, and reduced hours, posing substantial financial risks.

One of the major issues is the cyclical nature of the airline industry. Pilots must prepare for potential furloughs, layoffs, or reductions in hours. For instance, Spirit Airlines faced challenges with their Pratt & Whitney engines, affecting many pilots’ job security and financial stability. Thus, having a solid financial plan that accounts for these fluctuations is crucial.

Strategic Financial Planning for Pilots

Nick emphasizes the importance of a comprehensive financial plan tailored to each pilot’s specific needs and goals. The plan starts with maximizing retirement accounts, particularly the 401(k). Bonfire Financial partners with Charles Schwab, allowing access to the PCRA (Personal Choice Retirement Account). This partnership enables Nick to build custom strategies within pilots’ 401(k) plans, significantly impacting their retirement savings.

Additionally, Nick sets up tax-free Roth accounts for pilots and their spouses using the Backdoor Roth IRA strategy. Over time, these contributions grow significantly, providing a substantial tax-free retirement fund.

Medical and Long-Term Care Planning

Medical expenses are a significant concern for pilots, especially as they approach retirement. Many pilots come from military backgrounds and may have TRICARE benefits. However, each airline offers different medical benefits, which Nick meticulously reviews to maximize their potential.

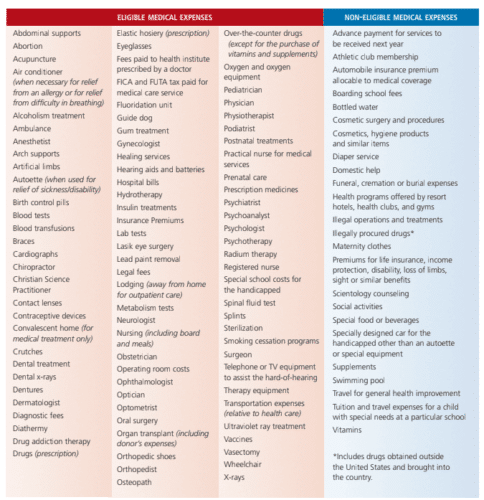

Health Savings Accounts (HSAs) are another critical component. These accounts provide a tax-free way to pay for medical expenses both now and in retirement. United Airlines, for example, offers HRA (Health Reimbursement Arrangement) and RHA (Retiree Health Access) accounts, which pilots can use to cover medical bills tax-free, reducing the need to tap into their 401(k).

Long-term care insurance is another essential aspect of financial planning for pilots. While disability insurance provided by airlines is generally comprehensive, it doesn’t cover long-term care. Nick advises pilots to consider long-term care insurance between the ages of 50 and 65 to cover potential future expenses not included in their standard benefits.

Estate Planning

Estate planning is crucial for everyone, not just pilots. Ensuring that assets are distributed according to one’s wishes is vital. Nick collaborates with estate planners and offers software solutions to help pilots create wills, estates, and trusts affordably. This planning is especially important for those with complex family situations, ensuring their financial legacy is secure.

Managing Risk and Alternative Investments

Pilots often have high salaries and generous benefits, leading to the issue of maximizing their retirement accounts too quickly. Nick addresses this by exploring alternative investments such as private real estate, private equity, and private credit. These options provide higher returns than traditional investments and help pilots build additional wealth once their foundational retirement accounts are maxed out.

Risk management is another critical area. Pilots typically want the best available investment strategies, which sometimes involves higher risks. Nick ensures that the baseline is secure, focusing on maximizing 401(k) returns and other retirement accounts. Once this foundation is established, he explores riskier investments to potentially yield higher returns.

Tax Planning and Roth Conversions

Tax planning is an integral part of Nick’s strategy. He emphasizes the importance of minimizing tax liabilities both now and in the future. One effective method is the Backdoor Roth IRA, which allows pilots to save tax-free. Another strategy is converting part of their 401(k) to a Roth IRA after retirement when their income is lower. This conversion leverages lower tax brackets, ensuring that future withdrawals are tax-free.

The timing of these conversions is crucial. Pilots often retire at 65 but aren’t required to take minimum distributions until 73. This gap provides an opportunity to convert portions of their 401(k) to Roth IRAs at a lower tax rate, significantly reducing their tax burden in retirement.

Personalized and Custom Approach

Nick’s approach to financial planning for pilots is highly personalized. He understands that each pilot’s situation is unique, requiring tailored strategies. Whether it’s setting up emergency funds, exploring alternative investments, or managing retirement accounts, Nick ensures that his clients are well-prepared for any financial eventuality.

He also emphasizes the importance of regular reviews. Meeting with clients every quarter allows Nick to adjust strategies as needed, ensuring that pilots stay on track to meet their financial goals. This proactive approach provides peace of mind, allowing pilots to focus on their careers and families while knowing their financial future is secure.

Conclusion

In conclusion, Nick Coleman’s expertise in financial planning for pilots offers invaluable guidance for navigating the unique challenges they face. His tailored approach, leveraging strategies like the PCRA, Backdoor Roth IRA, and comprehensive tax planning, ensures that pilots are well-prepared for a secure retirement. By focusing on personalized plans and regular reviews, Nick helps pilots achieve their financial dreams, from takeoff to touchdown in retirement.

Next Steps

For pilots seeking specialized financial advice, connect with Nick Coleman by setting up a call today!

Client Login

Client Login