Want your wealth to stand the test of time? Looking for Estate Planning Tips? Estate planning is one of the most important steps you can take to secure your legacy and protect your loved ones. While estate planning might not top your list of fun dinner topics, but let’s face it—neither does “who’s going to water the plants when I’m gone?” The truth is, getting your ducks in a row now means less chaos for your loved ones later. Think of it as future-you doing future-them a solid.

Without a plan, Uncle Sam (or worse, Cousin Eddie) might end up with more of your hard-earned wealth than you’d like. And trust us, Cousin Eddie does not need a new jet ski.

Estate planning doesn’t have to be overwhelming. Today we are diving into the basics of estate planning, common mistakes to avoid, and practical steps to secure your legacy for generations to come.

Listen anywhere you stream Podcasts

iTunes | Spotify | iHeartRadio | Amazon Music

The Foundation of Estate Planning

At its core, estate planning is about making decisions for the future. This includes determining how your assets will be distributed, who will handle your finances and medical decisions if you’re unable to, and ensuring your wishes are carried out effectively. While estate planning is highly customizable, certain foundational elements apply to everyone.

1. Power of Attorney (POA)

A Power of Attorney is one of the most critical components of any estate plan. This document allows you to designate someone to manage your financial and medical decisions if you’re unable to do so.

Financial POA: This ensures that someone you trust can pay bills, manage investments, and handle other financial responsibilities if you’re incapacitated.

Medical POA: This allows a trusted individual to make healthcare decisions on your behalf if you cannot.

Without these documents, your family may face significant legal hurdles to take care of essential matters.

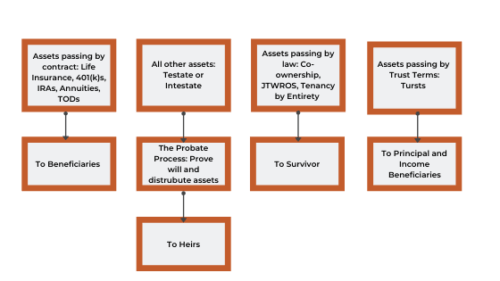

2. Beneficiary Designations

Your estate plan isn’t just about wills and trusts. Many financial accounts—such as retirement accounts, life insurance policies, and annuities—pass directly to beneficiaries you name on the account. Keeping these designations up to date is vital, especially after major life events like marriage, divorce, or the birth of a child.

3. Titling of Assets

Properly titling your assets is another critical step. Whether it’s an individual account, a joint account, or a trust, the title determines how the asset will be distributed. Improper titling can lead to confusion, legal battles, and assets being subjected to probate—a lengthy and expensive process. IF you only take away one estate planning tip from today, let it be this.

Common Estate Planning Mistakes

Estate planning is about more than just creating a will or trust. There are several common mistakes that can undermine even the most well-intentioned plans.

1. Failing to Notify Key People

Creating an estate plan is only half the battle. Many people forget to inform their financial advisors, attorneys, or executors about the plan’s details. This oversight can lead to assets being excluded from the plan or distributed incorrectly.

2. Neglecting Updates

Life changes, and so should your estate plan. Events like marriage, divorce, the birth of children, or the death of a loved one can all impact your wishes. Regularly reviewing and updating your plan ensures it aligns with your current circumstances.

3. Ignoring Beneficiary Designations

Even with a robust estate plan, failing to update beneficiary designations can create major issues. For instance, if an ex-spouse remains listed as a beneficiary on a retirement account, they will inherit those funds regardless of your intentions.

4. Overlooking Tax Implications

Estate planning isn’t just about who gets what; it’s also about minimizing taxes. Strategic planning can help reduce estate taxes, capital gains taxes, and other financial burdens on your heirs.

Tools to Simplify Estate Planning

Thankfully, estate planning doesn’t have to be overwhelming. With the right tools, tips and professional guidance, you can simplify the process and ensure your wishes are carried out effectively.

1. Trusts

Trusts are a powerful tool for managing and distributing assets. They can help avoid probate, provide for minor children, and ensure your assets are used according to your wishes. Some common types include:

Revocable Living Trusts: These allow you to maintain control over your assets during your lifetime while ensuring a smooth transition after your death.

Irrevocable Trusts: Often used for tax planning, these trusts remove assets from your estate, potentially reducing estate taxes.

2. Transfer on Death (TOD) Designations

For taxable accounts like brokerage accounts, you can add a TOD designation. This works like a beneficiary designation, allowing assets to transfer directly to the named individual without going through probate.

3. Professional Guidance

Estate planning involves legal, financial, and personal considerations. Consulting with an experienced attorney and financial advisor (like us) ensures that your plan is comprehensive and aligns with your goals.

Steps to Get Started

If you’re ready to tackle your estate planning, here’s how to get started:

1. Assess Your Assets

Take inventory of your financial accounts, real estate, personal belongings, and other assets. Understanding what you have is the first step in determining how you want it distributed.

2. Identify Key People

Decide who will serve as your executor, trustee, and agents for financial and medical powers of attorney. Choose individuals who are trustworthy, organized, and willing to take on these responsibilities.

3. Draft the Necessary Documents

Work with an attorney to draft essential documents like your will, trust, and POAs. Be sure to include instructions for the distribution of assets, care of minor children, and other specific wishes.

4. Communicate Your Plan

Inform your financial advisor, attorney, and key family members about your estate plan. Provide them with copies of relevant documents and ensure they understand their roles.

5. Review and Update Regularly

Set a reminder to review your estate plan every few years or after major life events. Keeping your plan up to date ensures it remains effective and aligned with your goals.

Why Estate Planning Matters

Estate planning is more than just a financial task; it’s a way to care for your loved ones, protect your legacy, and provide peace of mind. By taking the time to create a comprehensive plan, you can:

- Reduce stress for your heirs

- Minimize taxes and legal fees

- Ensure your wishes are honored

- Protect your assets for future generations

Final Thoughts

Estate planning may not be the most exciting topic, but it’s one of the most important. By using these tips and avoiding common mistakes, you can create a plan that prospers, protects, and passes on your wealth for generations. Whether you’re just starting or need to update an existing plan, now is the perfect time to take action.

If you’d like personalized guidance, we’re here to help. From leveraging estate planning software to connecting you with trusted attorneys, we can walk you through every step. Don’t leave your future to chance—start planning today, yes, really… take the first step and schedule a call, and help ensure your legacy lasts for years to come.

Client Login

Client Login