SMART TAX PLANNING IN RETIREMENT

Effective planning for taxes in retirement is paramount for retirees looking to maximize their financial security. Understanding the complexities of how different income sources are taxed can empower you to make informed decisions. This guide delves into strategies that can help reduce your tax liability and enhance your retirement income.

Understanding Retirement Tax Basics

Understanding the basics of taxes in retirement is crucial for effective financial planning. It can help ensure that you keep more of your hard-earned money during your golden years. As you transition from earning a salary to relying on various income sources in retirement, the way your income is taxed changes significantly. Retirement income can come from various sources, each with its own tax considerations. Familiarizing yourself with the tax treatment of 401ks, IRAs, pensions, and Social Security benefits is the first step toward efficient tax planning.

Types of Retirement Income

Retirement income can be categorized into three main types: taxable, tax-deferred, and tax-free. Each type has different tax implications that can affect your overall tax liability in retirement.

- Taxable Income: This includes income from traditional investment accounts, rental properties, and part-time employment. It’s taxed at ordinary income tax rates, which range depending on your total taxable income for the year.

- Tax-Deferred Income: Comes from accounts like traditional IRAs, 401ks, and other employer-sponsored retirement plans. Taxes on these accounts are deferred until you make withdrawals, which are then taxed as ordinary income. This can be advantageous because many people find themselves in a lower tax bracket in retirement compared to their working years.

- Tax-Free Income: Roth IRAs and Roth 401(k)s provide tax-free income in retirement, provided certain conditions are met. Contributions to these accounts are made with after-tax dollars, meaning you don’t receive a tax deduction when you contribute. However, both the contributions and the earnings can be withdrawn tax-free in retirement.

How to Reduce Taxes on Retirement Income

Strategic withdrawals from tax-deferred and tax-free accounts can significantly lower your tax bill. This section outlines how timing and the order of withdrawals can impact your overall tax situation.

Managing Social Security Taxation

Managing the taxation on Social Security benefits is a pivotal aspect of optimizing your retirement income. The tax liability on these benefits hinges on your “combined income.” This encompasses your adjusted gross income, nontaxable interest, and half of your Social Security benefits. The intricacies of this taxation mean that up to 85% of your benefits could be taxable if your income surpasses certain thresholds. Navigating these waters requires a nuanced understanding of how different income streams interact and impact the taxation of your benefits, making it essential to strategize effectively to minimize the tax bite.

Strategic measures, such as timing the withdrawal of funds from retirement accounts and potentially delaying the onset of Social Security benefits, can significantly influence your tax situation. Drawing on Roth IRA savings, which offer tax-free withdrawals, can be a smart move to manage your combined income levels. Thereby reducing the taxable portion of your Social Security benefits. These strategies underscore the importance of a well-thought-out plan that considers the timing and source of your retirement income, aiming to secure a more tax-efficient stream of income in your retirement years.

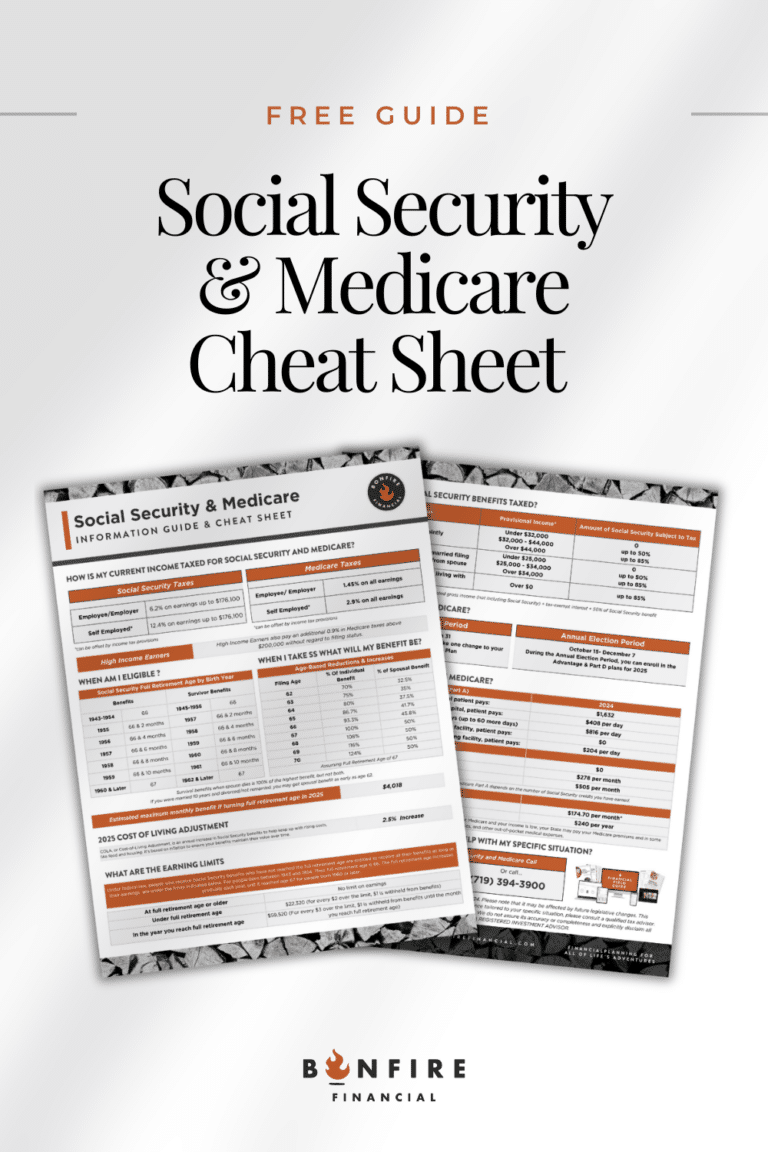

Need help understanding your Social Security Benefits? Download our updated Free Social Security Guide!

The Role of Investment Income

The role of investment income in retirement planning is pivotal. It not only supplements your primary income sources like Social Security and pensions but also carries specific tax considerations that can significantly impact your overall tax liability and financial stability in retirement. By strategically managing capital gains, dividends, and interest from investments, retirees can optimize their tax situation, potentially benefiting from lower tax rates on long-term capital gains and qualified dividends, thus enhancing their income streams while minimizing tax expenses.

Navigating Required Minimum Distributions

Navigating Required Minimum Distributions (RMDs) is an essential aspect of retirement planning, particularly for those with tax-deferred retirement accounts like traditional IRAs and 401(k)s. Once you reach the age of 73, the IRS mandates that you begin taking these distributions, which are then taxed as ordinary income. The amount of the RMD is calculated based on the account balance and life expectancy, creating a potential tax impact by increasing your taxable income in retirement.

Properly managing RMDs involves strategic planning to minimize their effect on your tax bracket, such as considering Roth conversions before reaching RMD age to reduce future taxable income or employing strategies like Qualified Charitable Distributions (QCDs) to meet RMD requirements tax-free by directly transferring funds to a qualified charity. This careful approach to RMDs can help maintain a more favorable tax position and preserve retirement savings.

Utilizing Roth Accounts for Tax-Free Income

This feature is particularly advantageous as it allows retirees to manage their taxable income more effectively. It can keep them potentially in a lower tax bracket and reduce or even eliminate taxes on Social Security benefits. Moreover, Roth accounts do not have Required Minimum Distributions (RMDs) during the account owner’s lifetime, providing further flexibility in planning and extending the tax advantages over a longer period. This makes Roth accounts a powerful tool in retirement income planning, offering tax diversification and the potential to optimize overall tax liability.

Estate and Gift Tax Planning for Retirement

Estate and Gift Tax Planning for Retirement is a critical strategy for managing how your assets will be distributed to your heirs while minimizing the tax impact on both your estate and the beneficiaries. This aspect of retirement planning involves understanding and navigating the complex rules surrounding estate and gift taxes, which can significantly affect the value of the assets transferred.

By leveraging annual gift exclusions, taking advantage of the lifetime estate and gift tax exemption, and setting up trusts or other estate planning tools, retirees can efficiently transfer wealth to their heirs or favorite charities, potentially reducing or eliminating estate taxes. Such planning ensures that more of your assets go to your intended recipients rather than to tax payments, preserving the financial legacy you wish to leave behind.

State-Specific Retirement Tax Considerations

State taxes can significantly affect your retirement finances. Each state has its own set of rules regarding income. Sales, property, and estate taxes can affect the overall tax burden on retirees. Some states offer favorable tax treatments, such as no state income tax, exemptions on Social Security income, or deductions for pension and retirement account withdrawals, making them attractive destinations for retirees. Understanding these differences is crucial for making informed decisions about where to live in retirement or how to allocate assets. Taking into account state-specific tax considerations can lead to substantial savings, enhancing the ability to maintain a desired lifestyle in retirement.

Healthcare Costs and Their Tax Implications

Healthcare Costs and their tax implications are a significant concern for retirees, given that healthcare expenses often increase with age. Navigating these costs requires an understanding of how they can affect your tax situation. For instance, certain healthcare expenses, including Medicare premiums and out-of-pocket costs for prescriptions, doctor’s visits, and medical procedures, can be deductible if they exceed a specific percentage of your adjusted gross income (AGI).

Leveraging a Health Savings Account (HSA), if eligible before enrolling in Medicare, offers a tax-advantaged way to save for and pay these expenses, with contributions being tax-deductible, growth tax-free, and withdrawals for qualified medical expenses also tax-free. Effectively managing healthcare costs and understanding their tax implications can significantly reduce your taxable income and lower your overall tax liability, providing more financial flexibility in retirement.

The Importance of Tax Diversification

Diversifying your retirement accounts can provide tax flexibility in retirement. It offers a strategic way to manage, and potentially minimize taxes on retirement income. Tax diversification involves spreading your investments across various account types. They could be taxable, tax-deferred, and tax-free—to create flexibility in how you can access funds in a tax-efficient manner. This strategy allows retirees to navigate the tax landscape more effectively. By choosing from different income sources in a way that keeps their taxable income in a lower bracket, they can reduce overall tax liability.

By having a mix of Roth IRAs, traditional retirement accounts, and taxable investment accounts, retirees can decide which accounts to draw from each year based on their current tax situation and future income predictions. This flexibility is crucial for managing taxes in response to changing tax laws and personal circumstances, ultimately leading to a more financially secure retirement.

How Tax Laws Impact Retirement Planning

Tax laws are continually changing. Staying informed and flexible in your planning is crucial for adapting to new laws and maximizing your retirement savings. These laws can affect how different types of retirement income are taxed. For instance, alterations in tax rates, adjustments to the rules governing retirement account contributions and distributions, and changes to estate tax exemptions can necessitate adjustments in how individuals save for retirement, when and how they withdraw from their accounts, and how they plan to pass on their assets.

Moreover, tax legislation can introduce new opportunities or challenges for retirees. Recent examples include adjustments to the age for RMDs and changes to the tax treatment of certain income sources. All of which can influence retirement timing decisions and income strategies. Therefore, staying informed about current and proposed tax laws is essential for effective retirement planning. It enables individuals to make proactive adjustments to their financial strategies. Thus, helping to ensure they can maximize their retirement savings’ growth and minimize their tax liabilities, thereby securing a more comfortable and financially stable retirement. Regular consultation with tax professionals and financial advisors can provide valuable guidance in navigating these changes, helping retirees to adapt their plans to benefit from favorable tax treatments or mitigate the impact of less favorable ones.

FAQs on Navigating Taxes in Retirement

How can I minimize taxes on my retirement income?

Minimizing taxes on retirement income involves several strategies, such as understanding the tax implications of various income sources, making strategic withdrawals from retirement accounts, and considering Roth conversions. It’s essential to balance withdrawals from taxable, tax-deferred, and tax-free accounts to manage your tax bracket effectively. Additionally, timing your Social Security benefits can also impact your tax situation. The same goes for managing investment income to take advantage of lower tax rates on long-term capital gains.

How can I reduce the taxes on my Social Security benefits?

To reduce taxes on Social Security benefits, you can manage your combined income. This includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. Keeping this combined income below certain thresholds will reduce or eliminate taxes on your benefits. Strategies include delaying Social Security benefits while withdrawing from tax-deferred accounts earlier, investing in Roth IRAs for tax-free income, and being mindful of how much and when you withdraw from taxable accounts.

What is the most tax-efficient way to handle my investment income?

The most tax-efficient way to handle investment income is to take advantage of tax-favorable investments and strategies. Holding investments for more than a year before selling can qualify you for long-term capital gains tax rates. Thiese are ower than ordinary income tax rates. Consider investing in tax-exempt bonds or funds, particularly if you are in a high tax bracket. Utilizing tax-loss harvesting can also offset any capital gains you might have, further reducing your tax liability.

How do Required Minimum Distributions (RMDs) affect my taxes?

RMDs from tax-deferred retirement accounts such as traditional IRAs and 401(k)s must start at a certain age and are taxable as ordinary income. These mandatory withdrawals can push you into a higher tax bracket, increasing your tax liability. Planning for RMDs involves considering strategies like starting withdrawals earlier to spread out the tax impact, converting to Roth accounts where RMDs are not required, or using RMDs for charitable contributions (Qualified Charitable Distributions) which can exclude the amount donated from taxable income.

What should I consider for tax planning if I’m moving to another state?

When moving to another state for retirement, consider the overall tax environment of the new state. This includes:

- Income tax rates

- Exemptions for retirement income

- Sales tax

- Property tax rates

- Any other local taxes.

Some states do not tax Social Security benefits or offer significant deductions on retirement income, making them more favorable for retirees. Additionally, evaluate the cost of living, healthcare facilities, and quality of life, as these factors also play a critical role in retirement planning.

How can I deduct healthcare expenses in retirement?

You can deduct healthcare expenses in retirement if you itemize deductions on your tax return and your medical expenses exceed a certain percentage of your adjusted gross income (AGI). This includes a wide range of out-of-pocket expenses. This includes:

- Premiums for Medicare and long-term care insurance

- Prescription drugs

- Costs associated with medical and dental care.

Using a Health Savings Account (HSA) for qualifying medical expenses can also provide tax-free money for healthcare costs, provided you have an HSA-compatible health plan before enrolling in Medicare.

Conclusion: Mastering Taxes for Retirement

Proactive tax planning is essential for securing your financial future in retirement. It requires a blend of knowledge, strategy, and the right support to navigate the complexities of tax planning. By taking control of your tax situation today, you’re not just helping to ensure a more prosperous retirement for yourself but also laying the groundwork for a lasting financial legacy. With the right approach and resources, you can minimize your tax liabilities, maximize your retirement income, and enjoy the peace of mind that comes with financial security.

However, mastering taxes doesn’t mean going at it alone. Leveraging the expertise of CERTIFIED FINANCIAL PLANNER™ and tax professionals can provide you the guidance and insight needed to navigate complex tax issues. These resources can help tailor a tax strategy that fits your unique situation, taking into account your income needs, tax bracket, and long-term financial goals.

Next Steps

Schedule a free consultation call with one of our CERTIFIED FINANCIAL PLANNER™ professionals. This initial consultation is an excellent opportunity to ask questions, address concerns, and get a sense of how we can help you achieve your retirement goals. Don’t miss out on this chance to lay a solid foundation for a secure and prosperous retirement. Take the next step today and schedule your free consultation call —it could be the most important call you make for your retirement future.

Client Login

Client Login