Turning 65 – A Retirement Checklist

Are your turning 65 soon? Turning 65 is a major milestone and pivotal age for your retirement planning. Not only is this an important age for government programs like Medicare and Social Security, but it’s also a perfect time to check other parts of your financial plan, particularly if you’re about to retire. Here are 6 important things to do as you get closer to your 65th birthday to make sure this year and the many years that follow are amazing! (P.S. Read to the end for a special bonus gift for turning 65!!)

- Prepare for Medicare

- Consider Long Term Care Insurance

- Review your Social Security Benefits

- Review Retirement Accounts

- Update Estate Planning Documents

- Get Tax Breaks

1. Prepare for Medicare

Medicare is the most common form of health care coverage for older Americans. The program has been in existence since 1965 and provides a way for seniors to have their health needs taken care of after they retire from the workforce.

What is Medicare?

Medicare is basically the federal government’s health insurance program for people 65 or older (or younger with disabilities). Medicare is primarily funded by payroll taxes paid by most employees, employers, and people who are self-employed. Funds are paid through the Hospital Insurance Trust Fund held by the U.S. Treasury.

When can I enroll in Medicare?

Starting 3 months before the month you turn 65, you are eligible to enroll in Medicare, you can also sign up during your birthday month and the three months following your 65th birthday. Essentially, you have a seven-month window to sign up for Medicare. Be mindful of your timing and enrollment because Medicare charges several late-enrollment penalties.

What does Medicare cover?

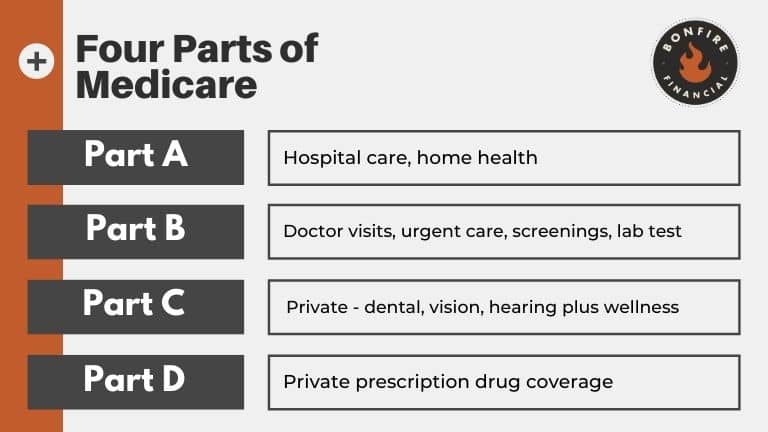

Medicare benefits vary depending on the enrollment plan you choose. Medicare is made up of four enrollment plans: Medicare Part A, Part B, Part C, and Part D.

Here is a quick breakdown of the four parts of Medicare:

Medicare Part A: Know as the Original Medicare, Part A covers inpatient hospital care, home health, nursing, and hospice care. Part A is typically paired with Medicare Part B.

Medicare Part B: Still considered part of the Original Medicare, Part B helps cover doctor’s visits, lab work, diagnostic and preventative care, and mental health. It does not include dental and vision benefits.

Medicare Part C: This option offers traditional Medicare coverage but includes more coverage for routine healthcare that you use every day, routine dental care, vision care, and hearing. Plus, it covers wellness programs and fitness memberships. Medicare Part C is also known as Medicare Advantage and is a form of private insurance. Note that you will not be automatically enrolled in these benefits.

Medicare Part D: Medicare Part D is a stand-alone plan provided through private insurers that covers the costs of prescription drugs. Most people will need Medicare Part D prescription drug coverage. Even if you’re fortunate enough to be in good health now, you may need significant prescription drugs in the future.

While Medicare is great it’s not going to cover all your medical expenses. You’ll still be responsible for co-payments and deductibles just like on your employer’s health plan, and they can add up quickly.

To offset these expenses, a Medicare Supplement (Medigap) insurance policy could be a good option as well. Medigap is offered by private insurance companies and covers such as co-payments, deductibles, and health care if you travel outside the U.S.

How can I enroll in Medicare?

For most people, applying for Medicare is a straightforward process. If you already receive retirement benefits from Social Security or the Railroad Retirement Board, you’ll be signed up automatically for Part A and Part B.

If you aren’t receiving retirement benefits, and you don’t have health coverage through an employer or spouse’s employer, you will need to apply for Medicare during your 7-month enrollment window.

You can sign up for Medicare online, by phone, or in-person at a Social Security office.

Please note that if you have a Health Savings Account (HSA) or health insurance based on current employment, you may want to ask your HR office or insurance company how signing up for Medicare will affect you.

2. Consider Long Term Care Insurance

Another prudent thing to do when you are turning 65 is to consider your long-term care insurance options before retirement.

What is long-term care insurance?

The goal of long-term care is to help you maintain your daily life as you age. It helps to provide care if you are unable to perform daily activities on your own. It can include care in your home, nursing home, or assisted living facility. The need for long-term care may result from unforeseen illnesses, accidents, and other chronic conditions associated with aging.

Medicare often does not provide long-term care coverage, so it is a good idea to factor this additional coverage in.

Why do I need long-term care insurance?

While it may be hard to imagine needing long-term care now, the U.S. Department of Health and Human Services estimates that someone turning age 65 today has almost a 70% chance of needing some type of long-term care service in their lifetime.

Unfortunately, long-term care coverage is often hindsight, only thinking about it once it is needed. Planning for it now can help you access better quality care quickly when you need it and help you and your family avoid costly claims.

How do I get long-term care insurance?

First, talk with a CERTIFIED FINANCIAL PLANNER™ about whether long-term care insurance makes sense for you. Coverage can be complex and expensive. A good Financial Advisor can help guide you to a plan that is right for you.

Most people buy their long-term care insurance through a financial advisor, however, some states offer State Partnership Programs and more employers are offering long-term care as a voluntary benefit.

It is important to start shopping before you would need coverage. While you can’t predict the future, if you wait until you are well into retirement and already having medical issues, you may be turned down or the premiums may be too high to make it a feasible option.

3. Review your Social Security Benefits

If you haven’t yet started to collect Social Security, your 65th birthday is a great time to review your social security strategy to help you maximize your benefits.

When can I take Social Security?

The Social Security Administration (SSA) considers the full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960 until it reaches 67. For anyone born in 1960 or later, full retirement benefits are payable at age 67.

In deciding when to start receiving Social Security retirement benefits, you need to consider your personal situation.

How can I maximize my Social Security Benefit?

Turning 65 might raise questions about how to maximize your Social Security befits in retirement. Rightfully so. Receiving benefits early can reduce your payments, however, the flip side is also true. If you’re still working or have savings that will allow you to wait a while on receiving benefits, your eventual payments will be higher. Your benefits can stand to grow 8% a year if you delay until age 70. Plus, cost of living adjustments (COLA) will also be included in that increase.

In addition to delaying receiving your benefits, it is important to make sure all your years of work have been counted. SSA calculates your benefits based on the 35 years in which you earn the most. If you haven’t clocked in 35 years, or the SSA doesn’t have those years recorded, it could hurt you.

Be sure to create a “My Social Security” account and check to make sure your work history is accurately depicted. It is wise to download and check your social security statement annually and update personal information as needed.

Another potential boost in your benefit can come from claiming spousal payments. If you were married for at least 10 years, you can claim Social Security benefits based on an ex-spouse’s work record.

Everyone’s financial situation is different, but it can be helpful to have a plan for how you’re going to approach Social Security before you turn 65.

4. Review Retirement Accounts

Even if you are not planning to retire soon, now (and every quarter for that matter) is a good time to check in on your retirement accounts. Is your portfolio allocated in a way that lines up with your target retirement date? When is the last time you met with your financial advisor? Do you need to catch up a little? Do you have a plan for your Required Minimum Distributions?

Meeting with a CERTIFIED FINANCIAL PLANNER™ can help you evaluate your risk tolerance in comparison to your retirement goals, make sure your investments are aligned to help you retire when you want, and make a plan for you to maintain the lifestyle you want in retirement.

A financial advisor can also help with planning for 401(k) catch-up contributions, RMDs, early withdrawals, or completing a Backdoor Roth.

A big hurdle as retirement approaches is often all the homework you have to do. Penalties, enrollments, coverage gaps, deadlines, etc. A great financial advisor can help guide you through this process.

If you are wondering how to find a great financial advisor, we have put a simple guide here. Or, we would love for you to schedule an appointment now to meet with one of our CERTIFIED FINANCIAL PLANNERs™.

5. Update Estate Planning Documents

The next item on the retirement checklist of important things to do when Turning 65 is to get your estate planning documents and legal ducks in a row. If you do not yet have an estate plan, will, medical directive, or financial power of attorney, it is time to get those in order. It is not too late! If you do have them, take some time to update them.

Have you had recent changes in personal circumstances? Do you need to update beneficiaries? Reviewing your plan at regular intervals, in addition to major life events, will help ensure that your assets and legacy are passed on in accordance with your wishes and that your beneficiaries receive their benefits as smoothly as possible.

Further, it is also a good idea to take inventory and organize all your financial documents. Keep a list of all your accounts (banking and investment), insurance, and estate documents as well as key contact information in a safe place. Make note of any safety deposit boxes you have. Keeping all this info organized and in one place will be a big help to your loved ones during a difficult time.

You’ll feel great knowing that you and your family are prepared

6. Get Tax Breaks

Finally, don’t let Medicare be the only gift to you when you turn 65. Starting in the year you turn 65, you qualify for a larger standard deduction when you file your federal income tax return. You may also qualify for extra state or local tax breaks at age 65.

Many states also offer senior property tax exemptions as well. For example, in Colorado for those who qualify, 50 percent of the first $200,000 of the actual value of the applicant’s primary residence is exempted. Check with your local tax assessor to see what property tax breaks may be available to you.

Turning 65 Birthday Advice

Relax and enjoy it. As much as turning 65 is a time to plan for retirement, it is also a time to celebrate.

If you plan to indulge in a much-deserved tropical getaway or a quick trip to visit your grandchildren, you may be able to take advantage of new travel discounts. Delta, American, and United Airlines all offer senior discounts on selected flights. Additionally, many hotels, car rental companies, and cruise lines all also offer senior discounts. So treat yourself!

Happy 65th! Cheers to many more!

Bonus Gift

FREE Social Security and Medicare

Cheat Sheet – Updated Annually

Want this all simplified? Grab your Free Social Security and Medicare Info Guide and Cheat Sheet

Have more questions? We’d love to talk. You can reach us directly at 719-394-3900 or you can schedule a call here!

Client Login

Client Login